Tax Extension Forms

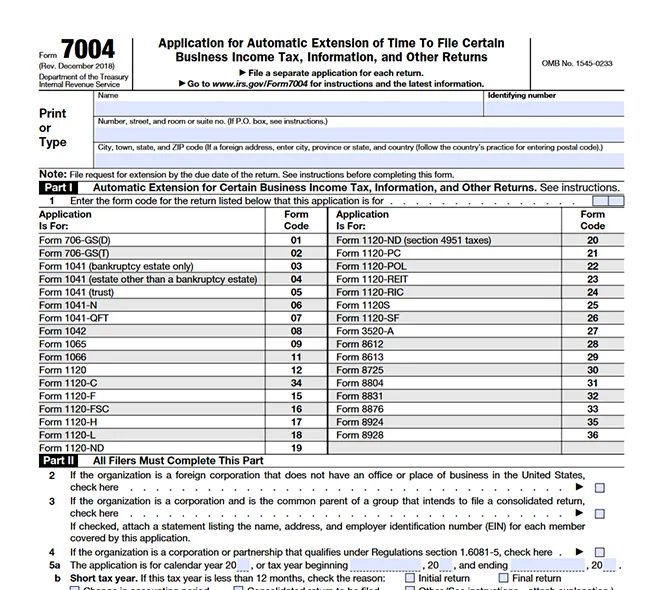

Forms 7004

The IRS Form 7004 is an extension form filed by businesses to get an automatic extension of up to 6 months to file certain business income tax.

File Form 7004

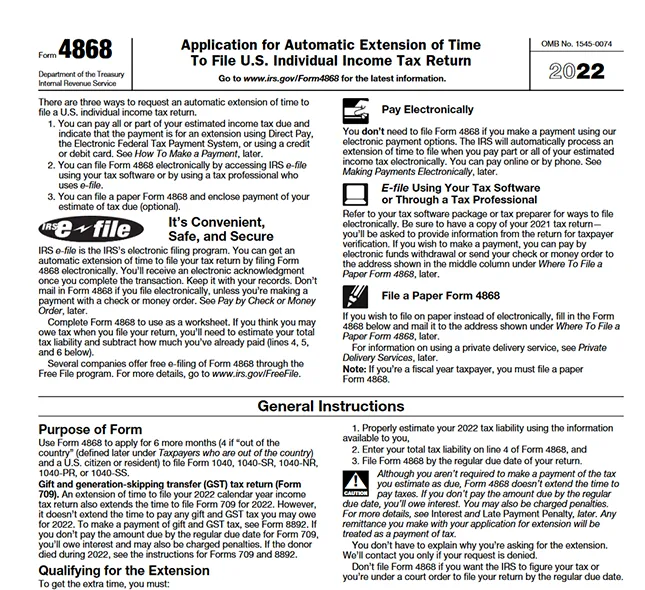

Forms 4868

Form 4868 offers individual taxpayers an opportunity to extend the due date for submitting their income tax return.

File Form 4868

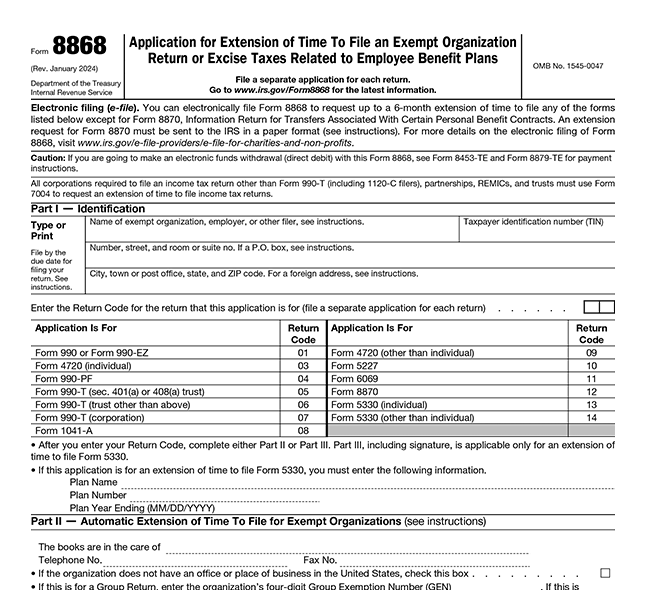

Forms 8868

Nonprofits and tax-exempt organizations can use Form 8868 to automatically postpone their annual tax return filing by 6 months.

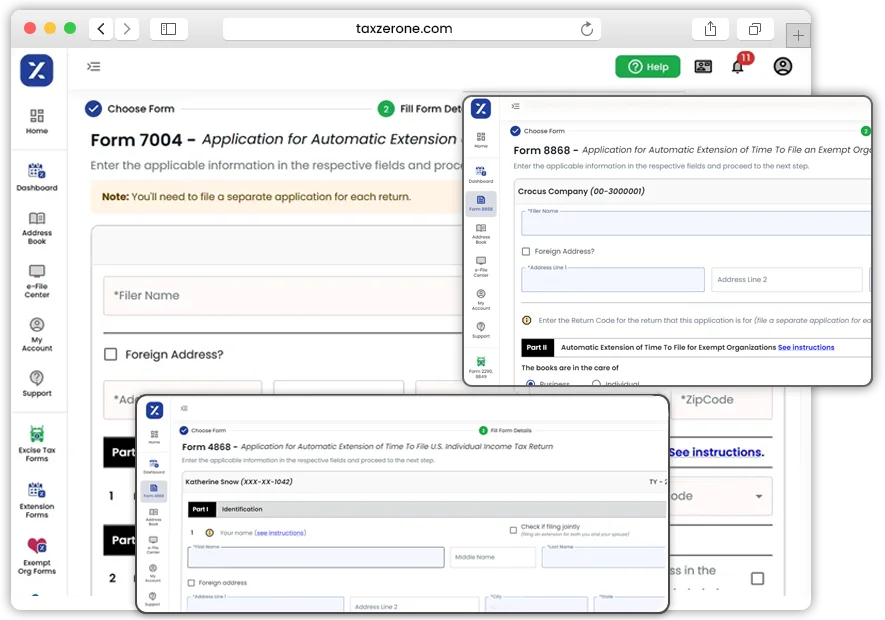

File Form 8868How to e-file IRS extension?

Fill out the form information.

Choose the specific extension form required for your filing.

Submit the extension form electronically to the IRS.

Receive confirmation upon IRS acceptance through notification or check the status within your TaxZerone account.

Who is TaxZerone?

TaxZerone is an IRS-authorized e-file service provider that assists businesses and individuals in easily and securely filing multiple IRS forms, including excise, employment tax, extension, information returns, and tax-exempt forms. Our trusted partner, TaxZerone

Why choose TaxZerone for e-filing extension forms?

Easy e-Filing

Easily submit your extension forms to the IRS through a simple online process. Follow the step-by-step guide to securely e-file and settle any outstanding balance with just a few clicks.

Authorized by IRS

TaxZerone has been granted authorization by the IRS to provide e-file services, allowing you to confidently submit your tax returns to the IRS through this secure online platform.

Real-time return updates

Receive immediate notification of your tax return's acceptance by the IRS, with the added convenience of checking its status through your TaxZerone account.

E-File tax extension form 7004, 4868 and 8868

with TaxZerone

E-file NowFrequently asked questions

What is Form 7004?

What is Form 4868?

What is Form 8868?

What business tax forms can be extended using Form 7004?

The extension generally applies to forms such as:

- Form 1065: U.S. Return of Partnership Income

- Form 1120: U.S. Corporation Income Tax Return

- Form 1120-C: U.S. Income Tax Return for Cooperative Associations

- Form 1120-F: U.S. Income Tax Return of a Foreign Corporation

- Form 1120-FSC: U.S. Income Tax Return of a Foreign Sales Corporation

- Form 1120-H: U.S. Income Tax Return for Homeowners Associations

- Form 1120-L: U.S. Life Insurance Company Income Tax Return

- Form 1120-ND: Return for Nuclear Decommissioning Funds and Certain Related Persons

- Form 1120-PC: U.S. Property and Casualty Insurance Company Income Tax Return

- Form 1120-POL: U.S. Income Tax Return for Certain Political Organizations

- Form 1120-REIT: U.S. Income Tax Return for Real Estate Investment Trusts

- Form 1120-RIC: U.S. Income Tax Return for Regulated Investment Companies

- Form 1120-S: U.S. Income Tax Return for an S Corporation

- Form 3520-A: Annual Information Return of Foreign Trust With a U.S. Owner

- Form 8612: Return of Excise Tax on Undistributed Income of Regulated Investment Companies

These are some common forms that businesses might file for which an extension can be requested using Form 7004.