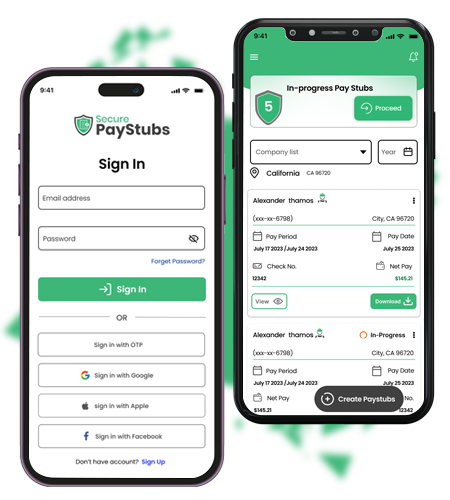

What makes SecurePayStubs the ideal choice for generating paystubs for 1099 independent contractors?

Generate Paystubs Instantly

Generate pay stubs for 1099 contractors in 3 simple steps—that's all it takes.

First Paystub for Free!

Experience why it’s the ideal choice for independent contractors—generate your paystub by simply following 3 easy steps and see how fast, accurate, reliable, and secure it is, all before you spend money.

Free Contractors paystub template

Create customized pay stubs without limitations, including logo incorporation, diverse templates, and extra elements.

Year to date calculations

You can generate pay stubs that include customized year to date (YTD) calculations.

Additional Earnings & Deductions

You have the option to include additional earnings and deductions when creating pay stubs.

Download or Email Paystubs

Once you've created the paystub, you have the option to download, print, or email it to your contractors.

How can I create a pay stub for 1099 independent contractors?

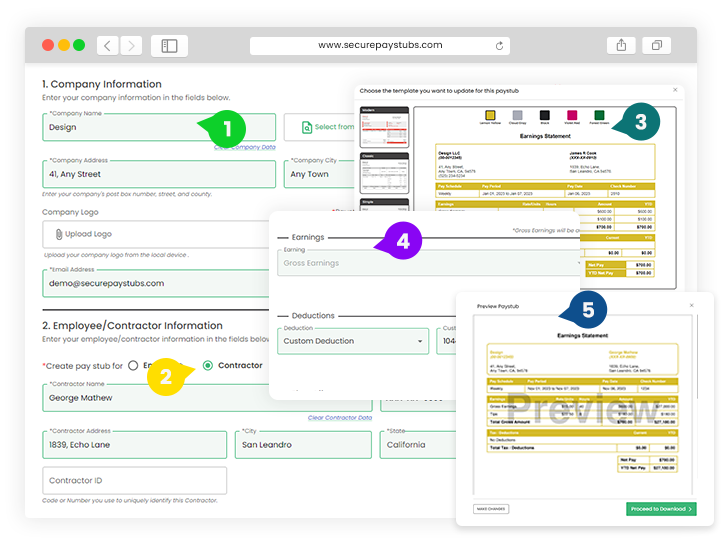

Simple process to generate pay stubs for 1099 independent contractors. Just follow these steps to enter the necessary information, choose a template, and download the pay stub in less than 2 minutes

- 1

Enter Company Information:

Provide the company's Name, Address, and EIN.

- 2

Enter Contractor Information:

Input your Name, SSN/EIN, and Address to generate your own pay stub.

- 3

Choose a Template:

Select a pay stub template and add the company logo if desired.

- 4

Add Additional Earnings/Deductions

Input your earnings information and any additional earnings or deductions. Specify the pay schedule, pay period, and payday. The system will automatically calculate Year to Date (YTD) figures, giving you an up-to-date overview of earnings and deductions for the current fiscal year.

- 5

Preview and Edit:

Review the pay stub information and correct any errors.

- 6

Download and Share:

Instantly download, print, or email the pay stub.

These steps, you can easily create accurate pay stubs for 1099 independent contractors.

Create a Paystub now! Generate professional pay stubs for independent contractors quickly!

Start now with our Online 1099 PayStubs Generator. Choose from a range of templates to suit your needs. Your first pay stub is free! From the second pay stub, it's just $2.99.

Testimonials

I've tried several paystub generators, but SecurePayStubs tops them all. It's fast, secure, and produces professional pay stubs”

- John D., Contractor

Finally, a tool that understands the needs of independent contractors. Generating my pay stubs is now a breeze, and they are accepted everywhere I need to present proof of income.

-Sarah L., Consultant

Frequently Asked Questions

Is this pay stub generator suitable for all types of independent contractors?

How secure is my information?

Can I generate pay stubs for previous months?

Is it necessary that independent contractors need a pay stub?

Having accurate track of pay stubs will help them while applying for a loan to buy a new house or automobile as they have their proof of income handy!

Can contractor pay stubs be used as proof of income?

Can a 1099 contractor get a pay stub?

How does the IRS classify someone as an independent contractor?

- Behavioral control

- Financial control calculations.

- Relationship of the parties