Employer Responsibilities: From Payroll to Year-End Reporting

Employers are responsible for more than just paying wages — they must handle tax calculations, submit quarterly returns, and complete year-end filings in full compliance with IRS and state requirements. Staying organized and timely is key to avoiding penalties and ensuring smooth operations.

IRS Tax Filing Made Easy for Employers

Employers are required to file various IRS forms to report wages, tax withholdings, and other payments on a quarterly and annual basis. Accurate and timely filing ensures compliance with federal regulations and helps avoid penalties. Below is an overview of key forms and their filing requirements.

Quarterly Filing: Stay On Track with Your Federal Tax Responsibilities

Employers must file Form 941 every quarter to report wages and withheld taxes, including Social Security and Medicare. Timely filing keeps you IRS-compliant and helps avoid costly penalties.

Here’s what you need to know:

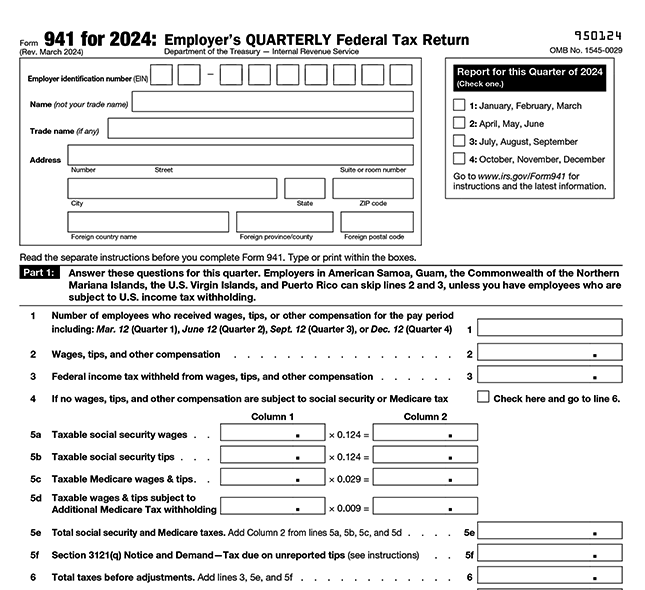

Form 941: Employer’s Quarterly Federal Tax Return

This form is essential for reporting employee wages and the taxes withheld, including federal income tax and both Social Security and Medicare contributions.

What you report: Total wages, withheld federal income tax, Social Security, and Medicare taxes.

When it’s due: Every quarter (April 30th, July 31st, October 31st, and January 31st).

File your 941 forms on time using TaxZerone. It simplifies your Form 941 preparation with step-by-step guidance, ensuring accurate data entry and seamless e-filing directly to the IRS for timely compliance.

Learn More About Form 941

Annual Filing: Complete Your Year-End Tax Obligations

As the year comes to a close, employers are responsible for filing various forms that detail wages paid, taxes withheld, and other payments made throughout the year. Here’s a breakdown of what’s required:

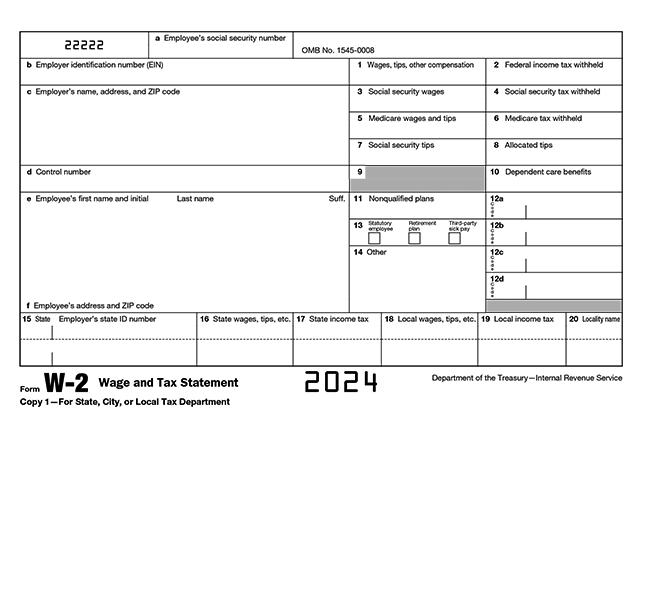

Form W-2: Wage and Tax Statement

Form W-2 summarizes wages paid to employees and the taxes withheld throughout the year. This form must be provided to both employees and the Social Security Administration (SSA).

What you report: Employee wages, federal and state taxes withheld, and Social Security contributions.

When it’s due: Provide W-2s to employees by January 31st and file with the SSA by the same date.

Generating and submitting W-2s is easy with TaxZerone. Simply enter your wage and tax data, then review and file your W-2s electronically. Streamline your year-end reporting with just a few clicks!

Learn more about Form W2

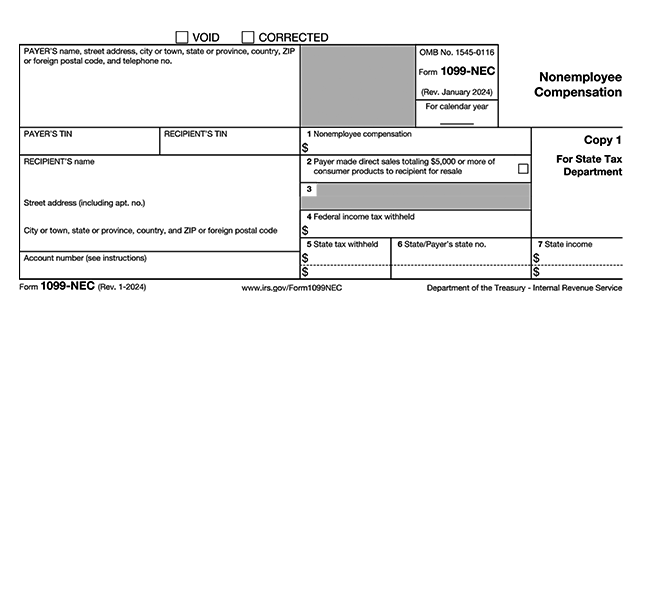

Form 1099-NEC: Nonemployee Compensation

If you’ve paid any independent contractors $600 or more throughout the year, you’re required to file Form 1099-NEC to report those payments.

What you report: Payments made to contractors for services rendered.

When it’s due: Provide Form 1099-NEC to contractors by January 31st and file with the IRS.

Easily generate and submit Form 1099-NEC with the help of TaxZerone. Enjoy a smooth, step-by-step process that ensures your compliance is hassle-free!

Learn more about Form 1099-NECForm 1099-MISC: Miscellaneous Income Reporting

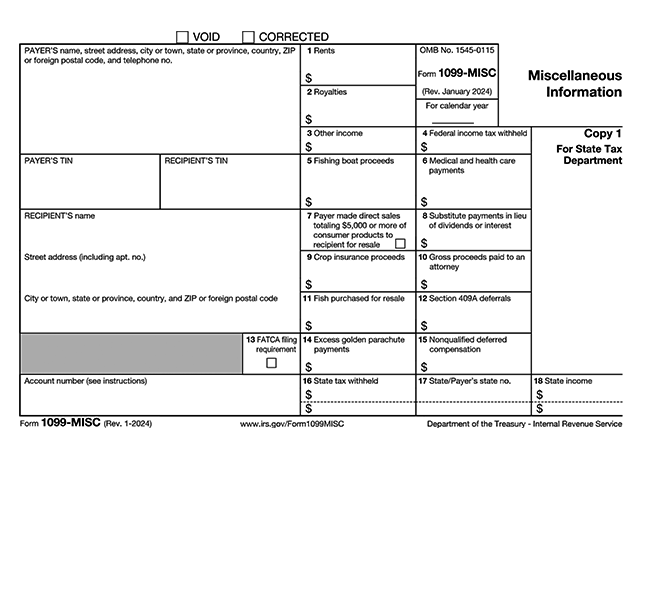

For any miscellaneous payments like rent, prizes, or legal fees, Form 1099-MISC is required. This form ensures that various types of income are properly reported to the IRS.

What you report: Income such as rents, royalties, and other miscellaneous payments over $600.

When it’s due: Submit to recipients by January 31st and file with the IRS by February 28 (or March 31 if filing electronically).

TaxZerone simplifies Form 1099-MISC filing by offering step-by-step guidance for accurate preparation and effortless e-filing with the IRS.

Learn more about Form 1099-MISC

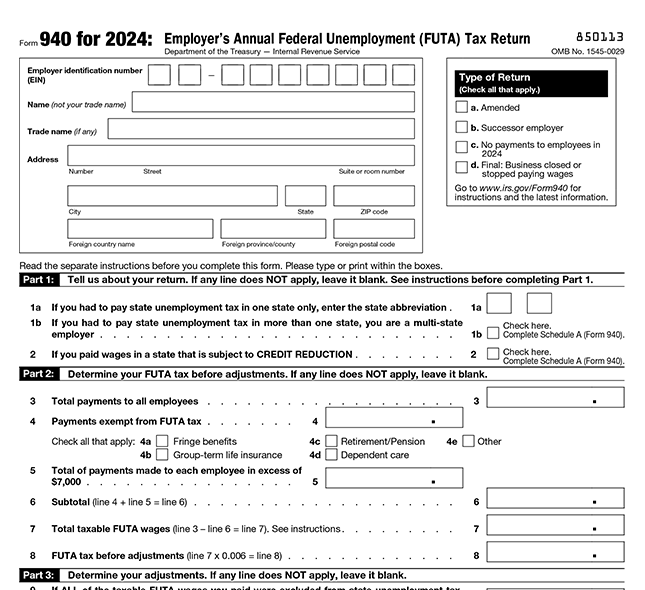

Form 940: Employer’s Annual FUTA Tax Return

Federal Unemployment Tax (FUTA) is used to fund unemployment benefits. Employers are responsible for reporting and paying FUTA taxes on an annual basis.

What you report: FUTA taxes based on employee wages.

When it’s due: File Form 940 by January 31st.

Avoid penalties and stay compliant! TaxZerone, takes care of your FUTA tax calculations and ensures your filing is timely.

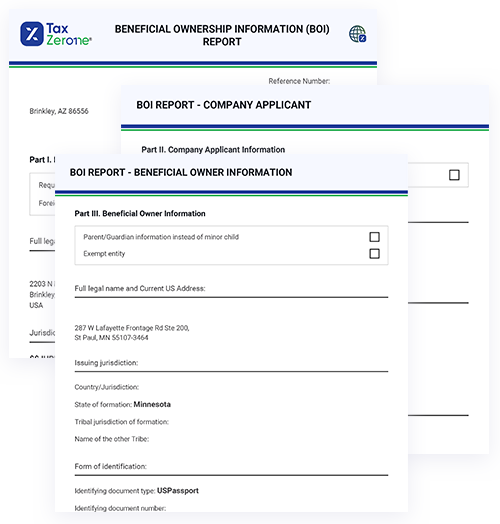

Learn more about Form 940Form BOIR: Beneficial Ownership Information Reporting

Form BOIR is used to disclose the beneficial owners of a legal entity to the Financial Crimes Enforcement Network (FinCEN). This form helps to ensure transparency and combats financial crimes like money laundering by identifying the true owners of companies.

What You Report: Information about the beneficial owners, including their name, date of birth, address, and identifying numbers.

When it’s due: Submit to FinCEN within 30 days of forming the entity, and file updates within 30 days if there are any changes to the beneficial ownership information.

E-file Form BOIR

Stay Compliant Year-Round with All-in-One Solution

Managing tax compliance is essential for every business, but it doesn't have to be difficult. TaxZerone’s all-in-one platform simplifies quarterly and annual tax filings, allowing you to stay compliant effortlessly while focusing on your core business. Start today and experience stress-free tax filing!

Get Started Today