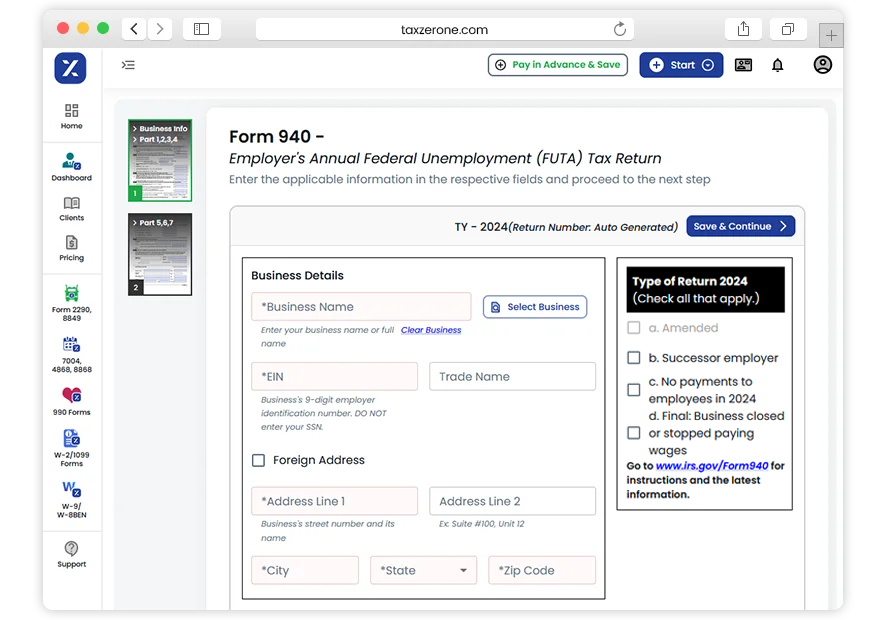

File IRS Form 940 for Your Business in Just 3 Simple Steps

Enter Your Information:

Provide details about your business, including employee payments and FUTA taxes.Pay & Sign:

Choose your preferred payment method to settle any FUTA balance due, and e-sign your Form 940.Transmit to the IRS:

Verify all information for accuracy, then submit your completed Form 940 directly to the IRS.

Benefits Of Filing Form 940 With TaxZerOne

IRS-Authorized

Your tax filings are handled securely and comply with all regulations. E-file your Form 940 with confidence, knowing it will be accepted and processed smoothly by the IRS.

Smart Business Validation

Benefit from our built-in smart validations, acting as your virtual tax assistant. These checks save time, minimize errors, and ensure accurate submissions for your peace of mind.

Instant Updates

Get real-time alerts on your 940 filing status. Receive immediate notifications when the IRS processes your return and track everything directly from your dashboard.

Affordable Form 940 filing

No hidden fees, no surprises. Get high-quality, cost-effective solutions for your tax needs.

E-sign Form 940

E-sign Form 940 quickly with your 94x online signature PIN. If you don’t have one, use Form 8453-EMP to e-sign and securely transmit your return to the IRS.

E-filing simplified

Our user-friendly interface ensures quick and effortless tax filing in minutes. Save time and stress with our streamlined process.

Who is TaxZerone?

TaxZerone is an IRS-authorized e-file service provider that assists businesses and individuals in easily and securely filing multiple IRS forms, including excise, employment tax, extension, information returns, and tax-exempt forms. Our trusted partner, TaxZerone ensures a seamless filing process.

Easy e-Filing

Submit your forms to the IRS effortlessly with our streamlined online process. Follow our simple guide to securely e-file and quickly settle any outstanding balances in just a few clicks

Authorized by IRS

TaxZerone is authorized by the IRS to offer secure e-filing services. You can trust us to handle your tax returns seamlessly and securely through our online platform

Real-time return updates

Get instant updates on your tax return's acceptance by the IRS and easily track its status using your TaxZerone account

Ready to file Form 940 for the 2024 tax year?

Get started with TaxZerone for an easy and seamless online filing experience.

File Form 940Frequently asked questions about IRS Form 940?

1.What is IRS Form 940?

2. Who needs to file Form 940?

3. When is Form 940 due?

4. How do I calculate the FUTA tax amount to report on Form 940?

To calculate your FUTA tax, determine the total amount of wages paid to employees, exclude any wages that are not subject to FUTA, and then apply the FUTA tax rate to the taxable wages. The standard FUTA tax rate is 6.0%, but it may be reduced based on state unemployment tax credits.

5. What should I do if I make an error on Form 940?

If you discover an error after filing Form 940, you should correct it by filing an amended Form 940 (Form 940-X). This form allows you to correct any mistakes or omissions and recalculate your FUTA tax liability.

6. Can a paystub generator help with Form 940 reporting?

Yes, a paystub generator can assist with Form 940 reporting by accurately calculating the wages subject to FUTA tax and keeping detailed records of employee earnings. This can simplify the process of determining the amounts to report on Form 940 and ensure accurate compliance with federal unemployment tax requirements.