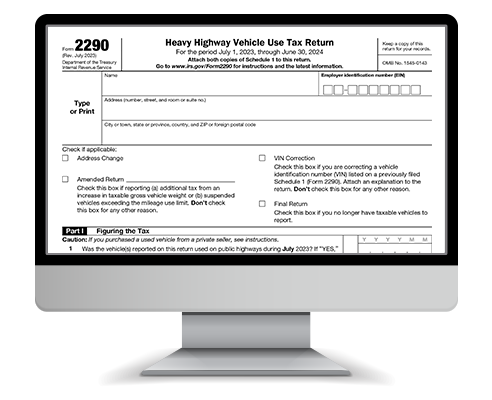

What is Form 2290?

IRS Form 2290 is used to report and pay the federal excise tax for heavy highway vehicles weighing 55,000 pounds or more. It's required for anyone who owns and operates such vehicles on public highways, including individuals, partnerships, corporations, and other organizations

Why choose TaxZerone to file Form 2290?

2290 Credits

Easily claim tax credits for overpaid HVUT through TaxZerone seamless process

Amendment Support

Correct your 2290 filings online with ease, including FREE VIN corrections, Mileage Exceed adjustments, and Weight Increases

Private Purchase Filing

Simplify timely 2290 private transfer returns for newly purchased heavy vehicles from private sales, ensuring IRS compliance

AutoMagic2290

Upload your previous year's Schedule 1 and let our smart system auto-fill the new return for you, streamlining the filing process

Bulk Upload Filing

Save time and ensure compliance with TaxZerone's bulk upload feature, allowing fleet managers to e-file multiple 2290 returns at once

Multiple Payment Methods

Securely pay your HVUT using various methods, including EFW, EFTPS, and credit/debit cards

Enjoy Complimentary Services for Your 2290 Filing

Free VIN Amendments, Rejected Return Refiling, and Tax Calculator

Free VIN Correction

Correct your VIN errors easily with our FREE VIN Amendment service. Fast and reliable updates—at no cost.

Free Refiling for Rejected Returns

If the IRS rejects your HVUT Form for any reason, you can make corrections and resend it at no extra charge

Free 2290 Tax Calculator

Estimate your Heavy Vehicle Use Tax in minutes using our Free 2290 Tax Calculator—fast, simple, and accurate.

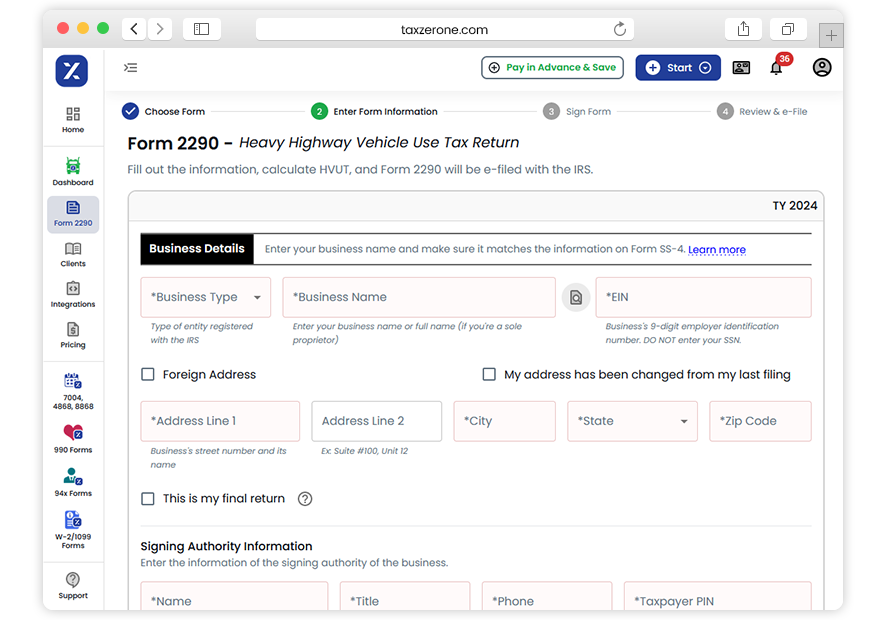

Get Your IRS-Stamped Schedule 1 in Just 3 Easy Steps with TaxZerone

Enter Form Information: Provide required details such as name, EIN, first used month (FUM), VIN, and taxable gross weight.

Review and Pay the Tax Due: Verify your form information and pay the balance tax due using EFW, EFTPS, or credit/debit card

Transmit & Get Schedule 1: Submit your return to the IRS and receive your stamped Schedule 1 once the filing is complete

Who is TaxZerone?

TaxZerone is an IRS-authorized e-file service provider that assists businesses and individuals in easily and securely filing multiple IRS forms, including excise, employment tax, extension, information returns, and tax-exempt forms. Our trusted partner, TaxZerone, ensures compliance and accuracy in filing

Easy e-Filing

Submit your forms to the IRS effortlessly with our streamlined online process. Follow our simple guide to securely e-file and quickly settle any outstanding balances in just a few clicks

Authorized by IRS

TaxZerone is authorized by the IRS to offer secure e-filing services. You can trust us to handle your tax returns seamlessly and securely through our online platform

Real-time return updates

Get instant updates on your tax return's acceptance by the IRS and easily track its status using your TaxZerone account

Stay Informed with TaxZerone.com: Explore Our Industry Blogs

HVUT Filing with Our Video Guides: Form 2290 Support Videos

Form 2290 Made Easy: Complete Guide to Filing Form 2290 Single Vehicle with TaxZerone

How to File IRS Form 2290 for Multiple Vehicles with TaxZerone: Bulk Upload Tutorial