What features make SecurePayStubs the ideal choice for generating pay stubs for self-employed individuals?

First Paystub for Free!

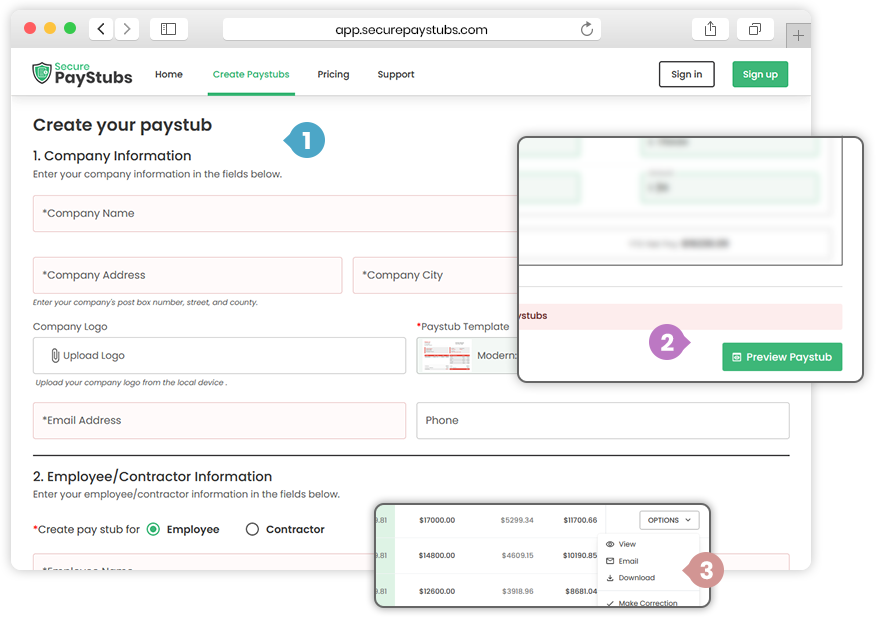

Experience why it’s the ideal choice for self-employed —generate your paystub by simply following 3 easy steps and see how fast, accurate, reliable, and secure it is, all before you spend money.

Accurate tax calculation

Our paystub generator accurately computes federal and state taxes, including FICA (Social Security and Medicare Taxes), based on current payroll laws

Year to date calculations

Automatically calculates Year-to-Date (YTD) earnings and deductions for the current fiscal year

Additional Earnings & Deductions

You can easily customize additional earnings and deductions with our paystub generator

Free paystub template

Create customized pay stubs without limitations, including logo incorporation, diverse templates, and extra elements

Here's how to generate pay stubs securely for self-employed individuals with SecurePayStubs

- 1

Provide Basic Information

Please provide basic details such as name, address, EIN/SSN, etc, including earnings such as salary and pay period. Additionally, specify any additional earnings or deductions as needed

- 2

Preview the Pay Stub

Select a pay stub template from our collection of free templates tailored for self-employed individuals. After previewing the pay stub, make any necessary corrections

- 3

Download the Pay Stub

Once the pay stub is generated, you can download or print it. We also offer the option to share pay stubs directly to your email

Generate your self-employed pay stub with SecurePayStubs!

Get your first pay stub for free, and pay just $2.99 for each additional one

Frequently Asked Questions

Can a self-employed individual make their own pay stub?

Can pay stubs of self-employed individuals be used as proof of income?

Can the template selected for self employed individual pay stub be changed?

Do self-employed individuals have paystubs?

Do self-employed individuals get paystubs?

What documentation can a self-employed use as proof of income?

- Annual Tax Return (Form 1040)

- Form 1099

- Bank statements (if you don’t have a corresponding 1099 form)

- Self-Employed Pay Stubs