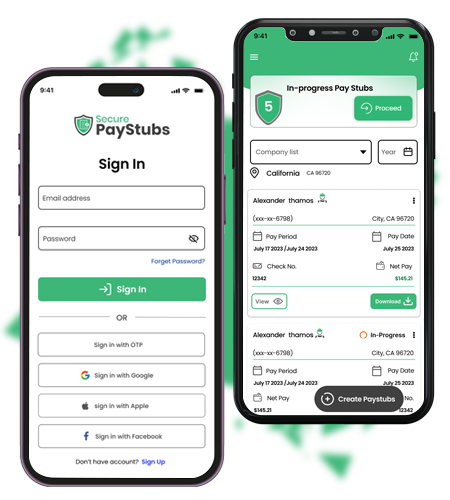

Generate Perfect Pay Stubs Anytime — Right from Your Mobile! Download Now

Instant and Accurate Online PayStub Generator

Our online paycheck stub creator is the perfect solution to professional pay stubs quickly and easily

Generate Paystubs Now!

FREE Paystub Generator for First-Time Users — Experience All Features and Benefits at No Cost.

Use code: FIRSTSTUB

0M+

Paystubs Generated

0K+

Businesses Served

0K+

Happy Users

What Is a Paystub?

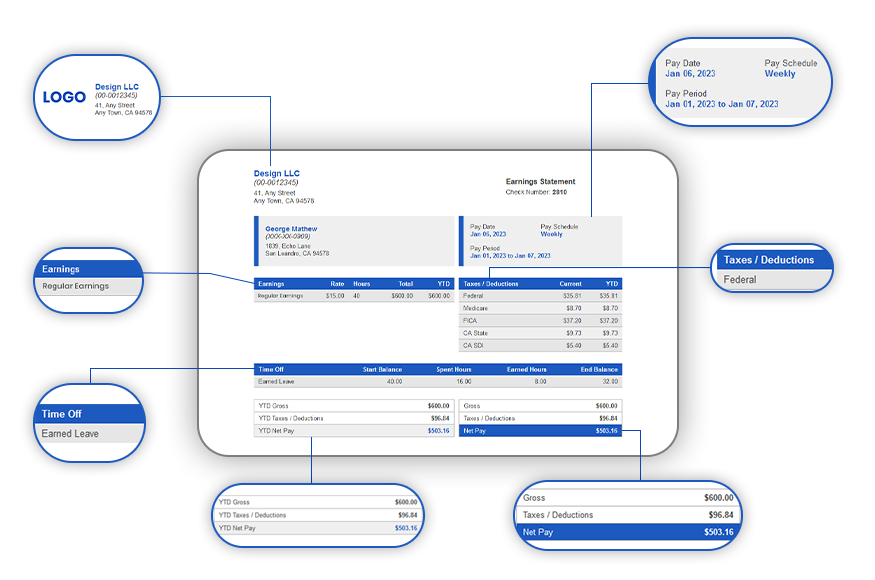

A paystub is a payroll document provided by an employer that shows an employee’s or contractor’s earnings, deductions, and net pay for a specific pay period. It helps workers verify income and track taxes, while helping employers maintain payroll accuracy and compliance.

Paystubs include gross pay, taxes, deductions, pay date, and year-to-date totals and are commonly used for tax filing, loans, rentals, and financial records.

Just a few simple steps to generate paystubs using our online paystub generator

Step 1

Choose the template and enter the information

Provide details such as the name of the organization, your working hours, and salary information.

Step 2

Review and preview the paystubs

Select your preferred template and preview your salary statement.

Step 3

Download and Email the paystubs

Instantly download and print your paycheck stub.

Who Needs Paystubs & Why They Matter

Small Business Owners & Employers

- Ensure legal compliance and maintain accurate payroll records.

- Build employee trust with transparency in payments.

- Reduce payroll disputes and improve professionalism.

Why Choose Our Paystub maker?

Quick and hassle-free

Our pay stub generator takes less than 5 minutes to complete

Comprehensive tax calculations

SecurePayStubs calculates all applicable taxes for pay stubs, including federal and state taxes for all 50 states, as well as FICA (Social Security and Medicare Taxes)

Accuracy ensured

To ensure accurate tax calculations, simply provide the necessary company, employee, and salary information

Security & Privacy Protected

Your data is encrypted and securely stored. Only authorized personnel can access it to ensure your information stays safe.

See How SecurePayStubs Beats Payroll Services

& Other Paystub Generators

Compare key features, costs, and usability to understand how SecurePayStubs provides a more efficient

and practical solution than payroll services and other pay stub generators.

| Feature | SecurePayStubs | Payroll Services | Other Paystub Generators |

|---|---|---|---|

| Pricing | Pay per stub — unbeatable price, no monthly fees. The first pay stub is free to experience all the features! | Monthly subscription plus per-employee fees — often too expensive for small businesses | Usually, too expensive and limited free options |

| Pay Stub Generation | Unlimited, fast & accurate | Included but costly | Basic with limited customization |

| Tax Calculations | Automatic, accurate & up-to-date | Automated (premium plans only) | Often outdated or manual |

| Tax Filing | Optional integration with TaxZerone, our sister product for seamless tax form filing | Automated filing included (premium) | Usually none |

| Customization | Full branding, templates, and easy addition of unlimited custom earnings & deductions | Limited | Minimal |

| Employee Access | Instant download or share to employees through email | Employee portal (subscription) | Some paystub generators lack easy sharing options |

| Additional Features | Add tips, deposit slips, repeat easily | Full payroll & HR features | Usually none |

| Best For | Small businesses & freelancers | Growing businesses needing HR | Basic users |

SecurePayStubs features that make pay stub generation easy

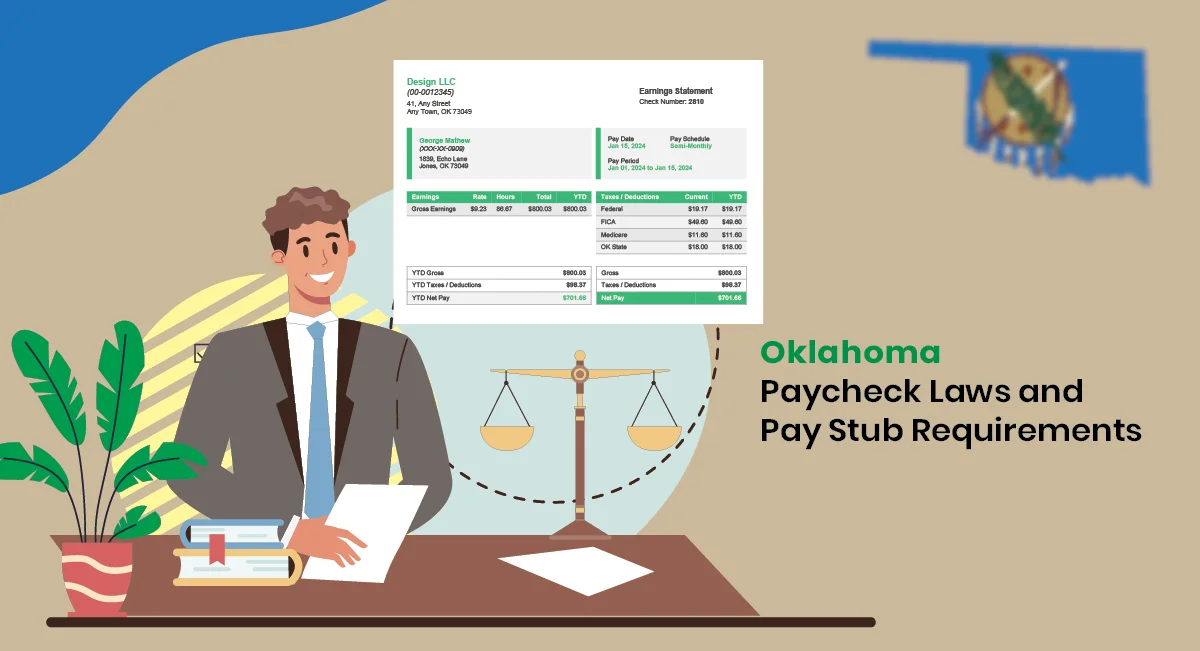

Supports All 50 U.S. States

SecurePayStubs supports all 50 U.S. states, helping you stay compliant with state-specific payroll and paystub regulations.

We automatically apply accurate federal, state, and local tax calculations, ensuring every paystub reflects the correct deductions based on the selected location.

Generate Paystub Now!Over 1.25 million pay stubs and 50,000+ users have trusted our paystub generator.

Pay stub templates look great and the customer support is excellent. Highly recommended.

-Jacinda Posey

It's user-friendly, accurate, and saves me so much time. Definitely worth the investment.

-Elizabeth Wilson

Loved it. It's incredibly easy to use and the tax calculations are spot on.

-James Parker

Very user-friendly. The customization options allowed me to create professional looking pay stubs.

-Michael Stoops

Want to create a pay stub accurately and instantly?

Create a Paystub nowRecent Blogs

Frequently asked questions about our Online Paystub Generator?

What is an online pay stub generator?

Why use an online paystub generator?

How can I create a pay stub as a small business owner?

What are the accepted payment methods?

Is a paystub the same as a paycheck?

How can I create my own pay stub by using paystub generator software?

- Input your company, employee information, and salary details, including gross pay, earnings, and deductions, for accurate tax calculations.

- Select a template that suits your business, preview the pay stub to ensure all information is correct.

- Download the pay stub and have it emailed to you!

Can I access previously generated paystubs?

Is it illegal to make a pay stub?

Pay stubs are legal when they are created using accurate and honest pay information. It only becomes illegal if a pay stub is made with false details or used to mislead, which is considered fraud.