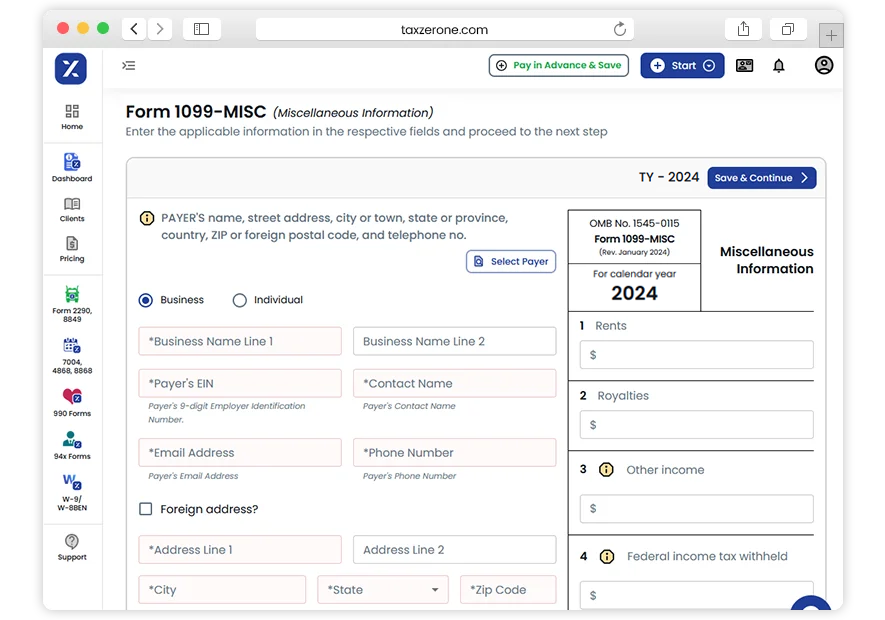

3 Simple Steps to Complete Your Form 1099-MISC E-Filing

Fill Out Form 1099-MISC:

Fill out the required fields, including your and the recipient’s information.Review & Transmit the Return:

Review the return for accuracy and transmit it to the IRS.Send the Recipient Copy:

Share the recipient copy with the contractor of our secure online portal.

Information Needed to File Form 1099-MISC Online

Payer Details:

- Name

- Employer Identification Number (EIN)

- Address

Recipient Details:

- Name

- Social Security Number (SSN) or Employer Identification Number (EIN)

- Address

Federal Filing Details:

- Miscellaneous Income

- Federal Tax Withheld (if any)

State Filing Details:

- State Income

- Payer State Number

- State Tax Withheld

Why Choose TaxZerone for Form 1099-MISC E-Filing

See how TaxZerone makes information return filing easier for you.

IRS Form Validations

Our platform is equipped with real-time validation checks to ensure your 1099-MISC forms meet IRS requirements, helping you avoid costly errors.

Supports Bulk Upload

Easily upload form information in bulk to streamline e-filing, whether you have a few forms or hundreds, eliminating the need for manual data entry.

Recipient Copies

Send recipient copies electronically via our online portal. Quick, secure, and straightforward for your convenience.

Best Price in the Industry

TaxZerone offers the most competitive pricing based on your return volume, providing reliable e-filing services without breaking the bank.

Form-Based Filing

Simplify the e-filing process with our intuitive form-based filing system, eliminating the need to navigate confusing interfaces.

Guided Filing

Benefit from step-by-step instructions to complete your filing accurately, with assistance available every step of the way to ensure no room for error.

Who is TaxZerone?

TaxZerone is an IRS-authorized e-file service provider that assists businesses and individuals in easily and securely filing multiple IRS forms, including excise, employment tax, extension, information returns, and tax-exempt forms. Our trusted partner, TaxZerone, ensures seamless and secure filing processes.

Easy e-Filing

Submit your forms to the IRS effortlessly with our streamlined online process. Follow our simple guide to securely e-file and quickly settle any outstanding balances in just a few clicks

Authorized by IRS

TaxZerone is authorized by the IRS to offer secure e-filing services. You can trust us to handle your tax returns seamlessly and securely through our online platform

Real-time return updates

Get instant updates on your tax return's acceptance by the IRS and easily track its status using your TaxZerone account

Ready to Simplify Your 1099-MISC Filing?

Enjoy a smooth and efficient e-filing process with ease.

E-File with TaxZerone NowFrequently Asked Questions

1.What is IRS Form 1099-MISC?

2. What types of payments are reported on Form 1099-MISC?

- Rent payments

- Royalties

- Prizes and awards

- Payments to independent contractors or freelancers

- Payments for legal settlements

3. When is the deadline to file Form 1099-MISC?

4. Who needs to file Form 1099-MISC?

Businesses and individuals must file Form 1099-MISC if they make payments of:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- At least $600 in rent, prizes, other income, medical payments, crop insurance proceeds, cash for fish purchases, payments to attorneys, or fishing boat proceeds.

- At least $5,000 for consumer products sold for resale outside a permanent retail establishment.