3 Simple Steps to Seamless Form W-2 E-Filing

Fill Form W-2

Enter your details and the employee's, including wages, federal income tax withheld, and Social Security and Medicare wages.

Review and Submit

Carefully review the form for accuracy and then transmit it electronically to the SSA.

Provide Employee Copy

Electronically send copies to recipients via our online portal.

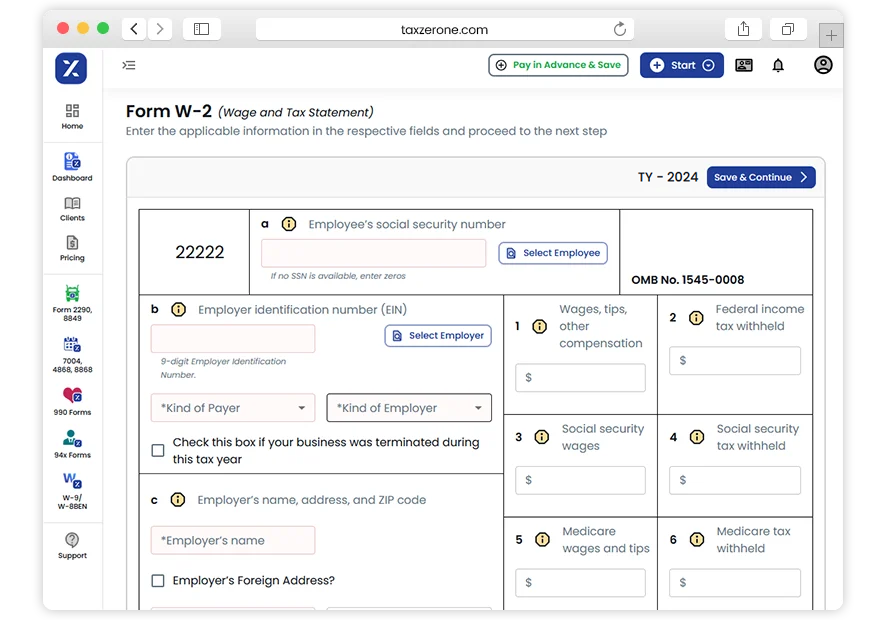

To e-file Form W-2, you will need to provide the following information:

Employer Information: Include the employer's name, Employer Identification Number (EIN), type of business, and address.

Employee Information: Provide details such as the employee's name, Social Security Number (SSN), address, and contact information.

Federal Tax Information: Report federal wages and the amount of federal income tax withheld.

FICA Tax Information: Include details on Social Security and Medicare taxes withheld.

State Tax Information: Report state wages and the amount of state income tax withheld.

Local Tax Information: Include any local, city, or other income taxes withheld.

Make sure all information is accurate to ensure a smooth e-filing process.

Why Choose TaxZerone for W-2 E-Filing?

Here's how TaxZerone makes your W-2 filing process smoother

W-2 Validations

Ensure precision and compliance with SSA requirements to reduce errors and rejections.

Recipient Copies

Easily transmit copies to recipients using our online portal. Enjoy swift and secure electronic delivery at your fingertips.

Competitive Pricing

Take advantage of industry-leading rates that fit your filing volume and budget.

Form-Based Filing

Input information directly through our user-friendly interface for a seamless filing experience.

Guided Filing

Follow clear instructions and prompts that guide you through each step of the e-filing process.

Who is TaxZerone?

TaxZerone is an IRS-authorized e-file service provider that assists businesses and individuals in easily and securely filing multiple IRS forms, including excise, employment tax, extension, information returns, and tax-exempt forms. Our trusted partner, TaxZerone , ensures a seamless filing experience

Easy e-Filing

Submit your forms to the IRS effortlessly with our streamlined online process. Follow our simple guide to securely e-file and quickly settle any outstanding balances in just a few clicks

Authorized by IRS

TaxZerone is authorized by the IRS to offer secure e-filing services. You can trust us to handle your tax returns seamlessly and securely through our online platform

Real-time return updates

Get instant updates on your tax return's acceptance by the IRS and easily track its status using your TaxZerone account

File Your W-2 Fast and Easy!

Get started now to quickly and accurately e-file your W-2 forms. Our simple platform makes it a breeze!

Get Started →Frequently Asked Questions

1. What is Form W-2?

2. When is Form W-2 due?

3. How do I correct a mistake on a W-2?

4. Who needs to file Form W-2?

Employers must file Form W-2 for every employee who received wages during the tax year. This requirement applies to both full-time and part-time employees, as well as certain other workers.

5. How can a pay stub generator assist with preparing W-2 forms?

A pay stub generator can assist by providing accurate and detailed payroll records, which are essential for correctly filling out W-2 forms. It helps in tracking earnings, taxes withheld, and other deductions, ensuring that the W-2 reflects accurate information.