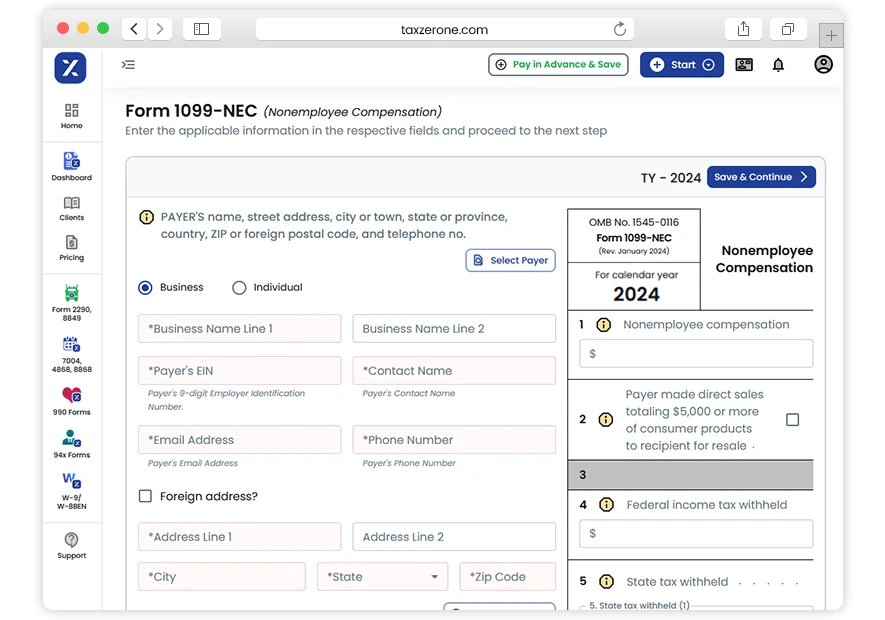

3 Simple Steps to Complete Your Form 1099-NEC E-Filing

Fill out Form 1099-NEC

Enter all required information, including your details and the recipient's details.

Review and Submit

Check the form for accuracy and then transmit it to the IRS.

Send Recipient Copy

Use our online portal to send recipient copies electronically.

Information Required to E-File Form 1099-NEC

Payer Information:

- Name

- Taxpayer Identification Number (TIN)

- Address

Recipient Information:

- Name

- Social Security Number (SSN) or TIN

- Address

Compensation Details:

- Amount of nonemployee compensation paid

State Filing Information:

- State incomee

- Payer state number

- State tax withheld

Why Choose TaxZerone for Form 1099-NEC E-Filing?

TaxZerone simplifies your information return filing with a user-friendly platform.

IRS Form Validations

Ensure accuracy and compliance with built-in IRS form validations, reducing the risk of errors and rejections.

Supports Bulk Upload

Save time with the ability to upload multiple Form 1099-NEC records at once, perfect for handling large volumes efficiently.

Recipient Copies

Effortlessly send recipient copies using our online portal. Experience fast and secure electronic delivery.

Best Industry Pricing

Benefit from our competitive pricing tailored to your return volume, allowing you to e-file your forms without overspending.

Form-Based Filing

Enjoy a straightforward filing experience with our user-friendly, form-based interface for entering necessary information directly.

Guided Filing

Navigate the e-filing process with ease using our intuitive interface, which offers clear instructions and helpful prompts to guide you every step of the way.

Who is TaxZerone?

TaxZerone is an IRS-authorized e-file service provider that assists businesses and individuals in easily and securely filing multiple IRS forms, including excise, employment tax, extension, information returns, and tax-exempt forms. Our trusted partner, TaxZerone

Easy e-Filing

Submit your forms to the IRS effortlessly with our streamlined online process. Follow our simple guide to securely e-file and quickly settle any outstanding balances in just a few clicks

Authorized by IRS

TaxZerone is authorized by the IRS to offer secure e-filing services. You can trust us to handle your tax returns seamlessly and securely through our online platform

Real-time return updates

Get instant updates on your tax return's acceptance by the IRS and easily track its status using your TaxZerone account

E-file Form 1099-NEC quickly and easily

Experience seamless, efficient, and compliant 1099-NEC e-filing today.

File Form 1099-NECFrequently Asked Questions

1. What is Form 1099-NEC?

2. Who needs to file Form 1099-NEC?

3. What information is required on Form 1099-NEC?

4. When is the deadline for filing Form 1099-NEC?

Form 1099-NEC must be filed with the IRS by January 31st of the year following the tax year. Recipients should also receive their copy by this date.

5. Can I file Form 1099-NEC electronically?

Yes, you can file Form 1099-NEC electronically through the IRS e-file system or through an IRS-authorized e-file provider, which is often faster and more efficient.

6. What should I do if I made a mistake on Form 1099-NEC?

If you discover an error after filing, you should file a corrected Form 1099-NEC as soon as possible. Use the "corrected" box on the form to indicate that you are submitting a correction.