Why Choose SecurePayStubs for Accurate Tax Calculation?

Handling payroll taxes can be challenging, but SecurePayStubs makes it effortless. Our system simplifies the entire process, ensuring that taxes are accurately calculated for every paystub. Here's why this feature is a game-changer for businesses of all sizes:

IRS Regulations: Staying compliant with IRS regulations is crucial for any business. SecurePayStubs ensures that your payroll and tax calculations align with the latest IRS guidelines, providing accuracy and peace of mind without the hassle of manual updates or adjustments.

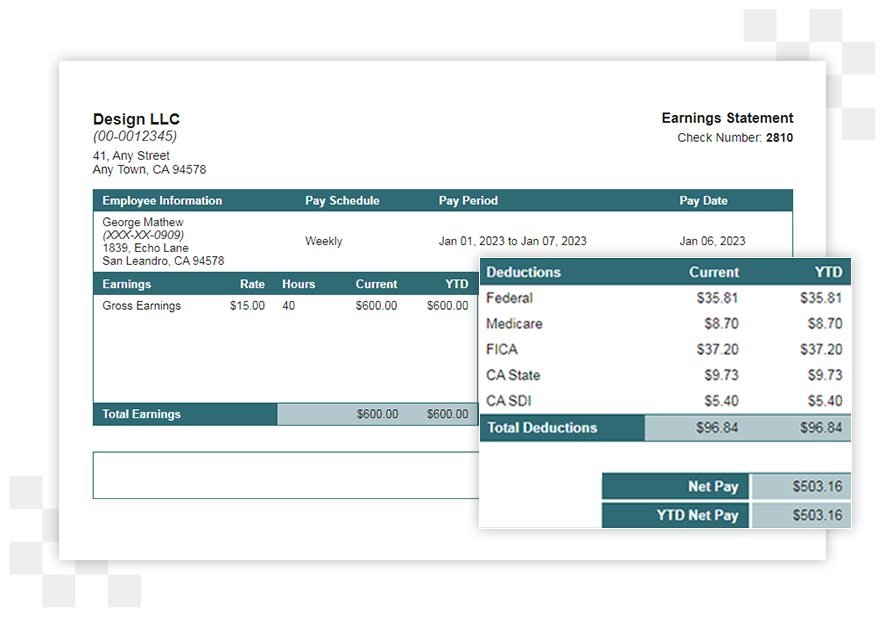

YTD (Year-to-Date): The system automatically calculates Year-to-Date (YTD) figures, offering an up-to-date overview of earnings and deductions for the current fiscal year. SecurePayStubs ensures accuracy with every pay period.

Quick & Easy: Create paystubs with accurate tax calculations in just a few steps — our platform does all the heavy lifting.

How Accurate Tax Calculation Works

With SecurePayStubs, tax calculation is simple, streamlined, and accurate.

Here's how it works:

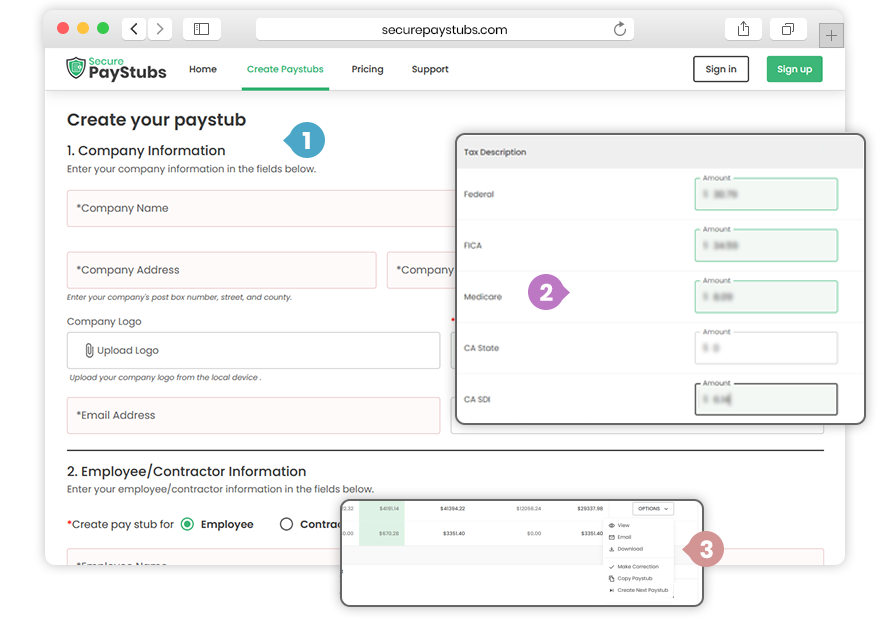

Input Employee Details: Enter basic employee information, such as salary and withholding preferences.

Automatic Calculations: Our platform automatically calculates federal, state, local taxes, Social Security, and Medicare based on the latest tax rules.

Generate a Paystub: Once all calculations are complete, simply generate and download the paystub.

Key Benefits of Our Tax Calculation Feature

1. Tax Calculation for Every Paystub

2. Automatic Tax Updates

3. Year-to-Date (YTD) Calculations

4. Error-Free Payroll

5. Comprehensive Tax Coverage

- Federal Income Tax

- State Income Tax (where applicable)

- Social Security & Medicare (FICA)

- Local Taxes

- Unemployment Taxes (FUTA and state)

6. Seamless Paystub Generation

Real-Time Compliance with Tax Laws

Tax laws change frequently, but SecurePayStubs keeps you up to date. Our platform is designed to automatically adjust to new regulations and tax laws, ensuring that your payroll process remains compliant without any manual updates.

Looking to generate pay stubs with accurate calculations?

Create pay stubs with accurate federal and state tax calculations with SecurePayStubs.

FAQs about Our Accurate Tax Calculation Feature

Does SecurePayStubs handle state-specific tax calculations?

How do I know my paystub’s tax calculations are accurate?

Can I edit tax calculations if I need to?

Get Started with SecurePayStubs Today

SecurePayStubs provides businesses with a seamless, efficient way to handle payroll while ensuring accurate, free tax calculations for every paystub. Whether you're a small business or a larger organization, our platform simplifies payroll management, so you can focus on what matters most — running your business.