On paystubs, year-to-date (YTD) information is important for both the businesses and employees alike. Employers benefit from understanding the entire amount paid to employees in the current calendar year, which helps with tax computations, reporting on finances, and employment law compliance.

Meanwhile, YTD information assists with financial management, tax preparation, and pay verification by providing employees with a comprehensive overview of their earnings and deductions from the beginning of the calendar year to the current pay period. Simplifying YTD information to enable efficient paystub administration for everyone involved, ensuring accurate year-over-year (YOY) comparisons and financial planning.

- What is YTD on a paystub?

- Key Components of Year-to-date Paystub Information

- Calculating Year-to-Date (YTD) Figures on a Paystub

- Importance of YTD Information on Paystubs

- Empower Your Financial Management with Year-to-Date (YTD) Data

What is year-to-date (YTD) on a paystub?

The term "year-to-date " (YTD) on a paystub signifies the time frame from the first day of the current calendar year to the moment. It comprises all income received during this period, as well as any deductions and taxes deducted. YTD numbers are very important for workers to keep track of their money and make plans accordingly.

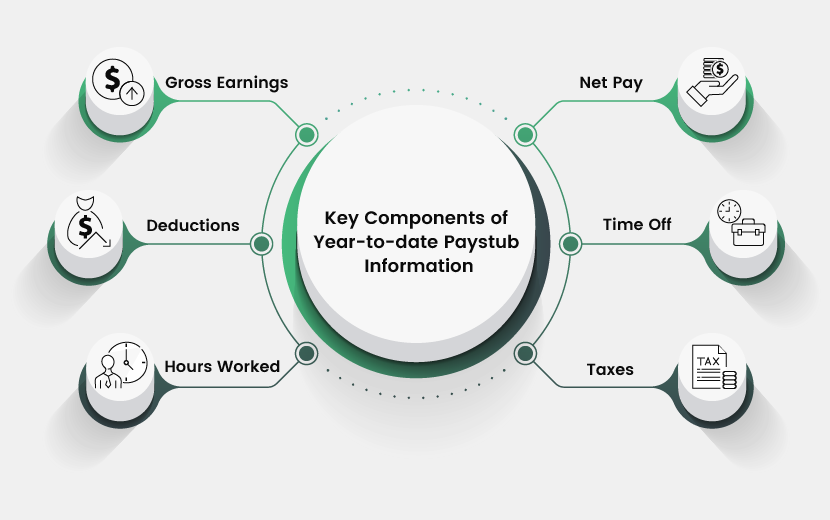

Key Components of Year-to-date Paystub Information

Gross Earnings: This represents the employee's whole revenue from the beginning of the year to the current pay period. It covers normal salary as well as commissions, bonuses, and overtime compensation.

Deductions: This includes all deductions taken from the employee's pay, such as taxes (federal, state, local), Social Security, Medicare, health insurance premiums, retirement contributions, etc.

Hours Worked: Some paychecks, particularly those for hourly employees, might show the total amount of hours worked so far for the year. This allows for keeping a record of the overall number of hours worked yearly.

Net Pay: The employee's YTD net pay is the total amount they have gotten after all deductions from their gross pay. In order to understand this calculation, one must know the difference between Gross Pay and Net Pay.

Accumulated time off: Employee vacation days, sick days, or other paid time off are accumulated by some employees. The YTD information for such employees may include the total amount accumulated so far in the year.

Taxes: This section usually details the total amount of taxes withheld from the employee’s paychecks since the year began. It breaks down the amounts withheld for federal income tax, state income tax, local taxes, Social Security, and Medicare.

Calculating Year-to-Date (YTD) Figures on a Paystub

Year-to-Date (YTD) total gross earnings for an employee encompass the sum of all earning types, including awards, incentives, allowances, differentials, etc.

For example, if a person receives a $50,000 base salary plus a $5,000 bonus, $1,000 in incentives, and $500 in allowances over the course of the year, their total year-to-date gross earnings come to $56,500

Making an annualized earnings calculation using the Year-to-Date (YTD) information seen on a paystub

- Start with the paystub's gross year-to-date earnings.

- Establish the YTD period, in days or weeks, if applicable.

- The daily average is obtained by dividing the gross YTD profits by the number of days in the timeframe.

- In order to forecast the annualized profits, multiply the daily average by 365 days.

As an illustration

A recent paystub shows that the gross revenue for the last 16 weeks is $6,640.

YTD Interval: 112 days (sixteen weeks x seven days a week).

The daily average is $59.29 each day ($6,640 / 112 days).

365 days x $59.29 each day = $21,639.29 is the annualized YTD income.

Importance of YTD Information on Paystubs

It's important for both employees and businesses to understand YTD information for the following reasons:

- Financial Planning: Year-to-date information allows individuals to accurately analyze their earnings and deductions, which leads to enhanced financial planning and budgeting.

- Tax Compliance: YTD figures aid in ensuring accurate tax withholding and reporting, helping employees avoid underpayment or overpayment of taxes.

- Verification: Employees may confirm the precision of their paystubs by contrasting the year-to-date figures with their own records and expectations.

Here are some tips for managing your YTD numbers on pay stubs:

- Keep Correct Records: To provide accurate YTD statistics, maintain thorough records of all paystub activities, guaranteeing correct earnings, deductions, taxes, and contributions.

- Check and Balance Review: Periodically review YTD figures on paystubs to spot discrepancies or errors, promptly addressing any issues to maintain accuracy.

- Employee Education: Clearly explain to employees the meaning and methodology of the year-to-date data calculations. Provide educational resources on taxes, retirement planning, and financial literacy to promote informed decision-making.

- Use Paystub Software: Invest in trustworthy paystub creation software to automate year-to-date computations and presentations. Look for flexible templates and easy connection with other systems to ensure consistency and accuracy in year-over-year financial evaluations.

Empower Your Financial Management with Year-to-Date (YTD) Data

Understanding the year-to-date (YTD) data on your employee pay stub is critical for financial management.

SecurePayStubs simplifies the procedure so that both employers and employees can understand the process. Employers can make informed financial decisions by checking the YTD details about gross earnings, hours worked, deductions, and taxes withheld. Start acting now, and use the YTD insights through our reliable paystub generator to achieve precise tax projections and manage paystubs easily.

This article has been updated from its original publication date of May 2, 2024.