The earning statement in workplace finances is an important document and is widely referred to as a pay stub. The purpose of this manual is to provide an insight to employers on how earning statements are structured, their significance as well as how they are distributed.

- What is an Earning Statement?

- Who Needs Earning Statements?

- Key Components of an Earning Statement

- The Significance of an Earning Statement

- How to Read an Earning Statement

- Common Concerns

- Tips for Employers

- Simplify Paystubs with SecurePayStub

- Why Choose SecurePayStubs?

What is an Earning Statement?

An earning statement, also known as a pay stub, is a detailed document issued to employees showing the details of their earnings and deductions for a particular pay period; it is a necessary documentation for the facilitation of transparency, aids in financial planning hence keeping record of the earnings, deductions and net pay between employers and employees.

Who Needs Earning Statements?

Earning statements or Pay stubs aren't just for traditional employees—they’re essential for a wide range of individuals and business types:

- Small Business Owners & Employers: Ensure compliance, transparency, and professionalism by providing employees with accurate pay stubs for each pay period.

- Independent Contractors & Freelancers: Generate professional pay stubs to verify income for loans, rentals, or tax filing.

- Gig Workers & Self-Employed Individuals: Use pay stubs to maintain a reliable income record when formal payroll isn’t provided.

- Employees: Track earnings, deductions, and net pay for budgeting, dispute resolution, and filing taxes.

- Landlords, Lenders & Agencies: Frequently request pay stubs as proof of income when reviewing applications for loans, housing, or financial assistance.

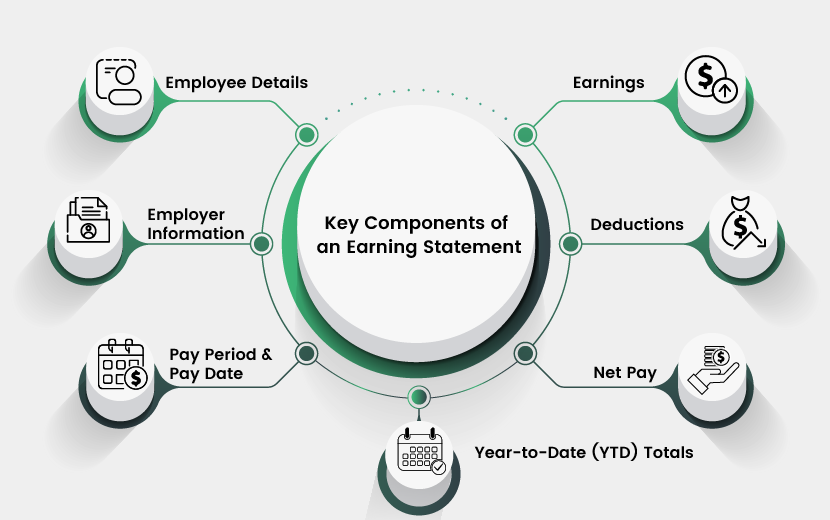

Key Components of an Earning Statement

The main components of an Earning statement are the following: employee and employer information, pay period specifics, earnings breakdown, deductions, net pay, and year-to-date totals.

Employee Details

Key details about the employee included in this section:

- Name: The employee’s official name.

- Address: Where the employee resides.

- Employee ID(optional): A company ID number

- Social Security Number: The last four digits of the employee’s social security number.

Employer Information

Essential details about the employer provided should be included in this section:

- Company Name: The legal name of your business.

- Address: Business address of your company.

- Employer Identification Number (EIN): A unique nine-digit number assigned by the IRS to businesses for filing tax returns and other tax-related purposes.

Pay Period Details

You should indicate the clear state of the following:

- Pay Period Start and End Dates: This includes the dates in which a pay period starts and ends, defining the time which an employee is paid.

- Pay Date: The date on which payment is received by the employee for the stipulated pay period

Earnings

This segment separates employee wages into different parts as follows:

- Gross Wages: Gross wage represents earnings before any deductions and includes all types of payments such as hourly wages, salaries, etc.

- Regular Hours and Pay: The hours an employee works before they get into overtime are referred to as regular hours, which attract normal pay rates.

- Overtime Hours and Pay: These include extra hours put in over and above one’s usual work time as well as the increased payments for them.

- Bonuses, Commissions, and Other Earnings: This includes any other sort of pay such as bonuses, commissions as well as other special payments.

Deductions

When calculating employee paychecks, there are deductions that reduce the gross pay amount before it reaches the employee. Here's a breakdown:

- Pre-Tax Deductions: These are amounts taken out before taxes are calculated. They include contributions to retirement plans, health insurance premiums, and flexible spending accounts.

- Tax Withholdings: This is the money withheld for federal, state, and local taxes.

- Post-Tax Deductions: These are deductions taken out after taxes have already been calculated. Examples include union dues, garnishments (court-ordered payments) and charitable contributions.

Net Pay

Net pay is the final amount of an employee's paycheck after subtracting deductions like taxes, retirement savings, and health insurance premiums from their gross pay.

Year-to-Date (YTD) Totals

Year-to-Date (YTD) Totals provide on overview of earnings and deductions accumulated from the beginning of the year until the current pay period. It aids in monitoring total Year to Date(YTD) income and deductions in accordance with individual employees’ annual fiscal budget.

The Significance of an Earning Statement

An earning statement is very important in terms of financial transparency. It provides a breakdown of the gross pay and the various deductions, enabling employees to know their earnings as well as deductions. Tax preparation requires this transparency because earning statements tell the amount with-held for taxes that helps one to file accurate return forms.

Additionally, in many cases, loan and credit applications require earning statements to confirm income. Earning statements also serve personal financial management purposes and whenever there are disputes in pay.

How to Read an Earning Statement

Let's check out some key steps to understand the earning statement accurately and ensure financial clarity.

Verify Personal and Employment Information

Ensure that the employee’s name, address, and social security number are correct to avoid any identity mix-ups or errors in their records.

Check the Pay Period and Pay Date

Confirm the pay period start and end dates and the pay date. This helps employees understand the timeframe their earnings cover and ensures they are paid for the correct period.

Review Earnings and Deductions

Carefully review all listed earnings and deductions. Make sure that the regular and overtime hours are correct, and verify the accuracy of all deductions. Look for any discrepancies or unfamiliar entries that may need clarification.

Understand Net Pay

Know how much the employee is actually receiving (net pay) after all deductions. This amount is crucial for their budgeting and financial planning.

Monitor Year-to-Date Totals

Keep track of cumulative earnings and deductions to avoid surprises at tax time. This helps employees understand their financial status and plan for any tax obligations.

Common Concerns

Let's address some common concerns employees may have regarding their earning statements and tax deductions.

Why is Net Pay Different from Gross Pay?

Gross pay is the total earnings before any deductions, including all wages, salaries, bonuses, and other forms of compensation. Net pay, on the other hand, is what the employee receives after all deductions, such as taxes, insurance premiums, and retirement contributions, have been subtracted. The difference between gross and net pay represents these mandatory and voluntary deductions.

What Should Employees Do if They Find an Error?

If an employee discovers an error in their earning statement, they should immediately contact their employer to report the error and request a correction. Prompt reporting ensures that any mistakes are rectified quickly, preventing potential financial discrepancies or tax issues.

Why Are There Multiple Tax Deductions?

Different types of taxes are required by law to be withheld from employees' earnings. These typically include federal income tax, state income tax, and local taxes, as well as Social Security and Medicare taxes. Each of these serves different purposes and is mandated by different levels of government.

How Can Employees Use Their Earning Statement for Tax Purposes?

Earning statements provide detailed information on the taxes withheld from an employee’s paycheck, which is crucial for filing tax returns. The statement shows total earnings and the total amount of taxes withheld, helping employees to accurately report their income and calculate any additional tax payments or refunds due.

Tips for Employers

Let's see some essential tips for employers to ensure accurate earning statements and maintain compliance.

- Ensure Accuracy Double-check all entries before issuing pay stubs to avoid errors. Accurate earning statements help maintain trust and prevent disputes.

- Be Transparent Clearly explain any deductions or earnings categories that might not be self-explanatory. Providing a glossary or explanatory notes can help employees understand their pay stubs better.

- Provide Access Ensure employees have easy access to their earning statements, whether electronically or in print. Consistent and convenient access helps employees stay informed about their earnings and deductions.

- Stay Compliant Keep up with federal and state laws to ensure all necessary deductions are made and reported correctly. Compliance with regulations helps avoid legal issues and ensures fair treatment of employees.

Simplify Paystubs with SecurePayStubs

At SecurePayStubs, we offer a seamless online paystub generator that ensures accuracy and compliance. Our platform is designed to cater to all your paystub creation needs with ease and efficiency.

Why Choose SecurePayStubs?

User-Friendly Interface: Our intuitive online tools allow you to generate pay stubs quickly and easily, saving you time and effort.

Accurate Calculations: Our system ensures all calculations for taxes, deductions, and net pay are accurate, reducing the risk of errors and ensuring compliance with paystub regulations.

Customizable Templates: We offer a variety of templates to suit your business needs, allowing you to create pay stubs that reflect your company’s branding and requirements.

Secure Data Handling: We prioritize the security and confidentiality of your information, ensuring that your data is protected with the highest standards of security.

Visit SecurePayStubs today to start creating accurate and compliant earning statements effortlessly.

This article has been updated from its original publication date of May 30, 2024.