What Is Form W-2c?

Form W-2C, officially known as the Corrected Wage and Tax Statement, is used by employers to correct errors on previously filed Form W-2.

You can fix incorrect employee names, Social Security Numbers, wages, or tax withholdings to maintain compliance with the IRS and Social Security Administration (SSA).

Filing a W-2C ensures both employer and employee records are accurate, avoiding mismatched tax data and potential penalties.

How to E-File Form W-2C Online in 3 Easy Steps

E-filing your W-2C form online is simple, secure, and efficient

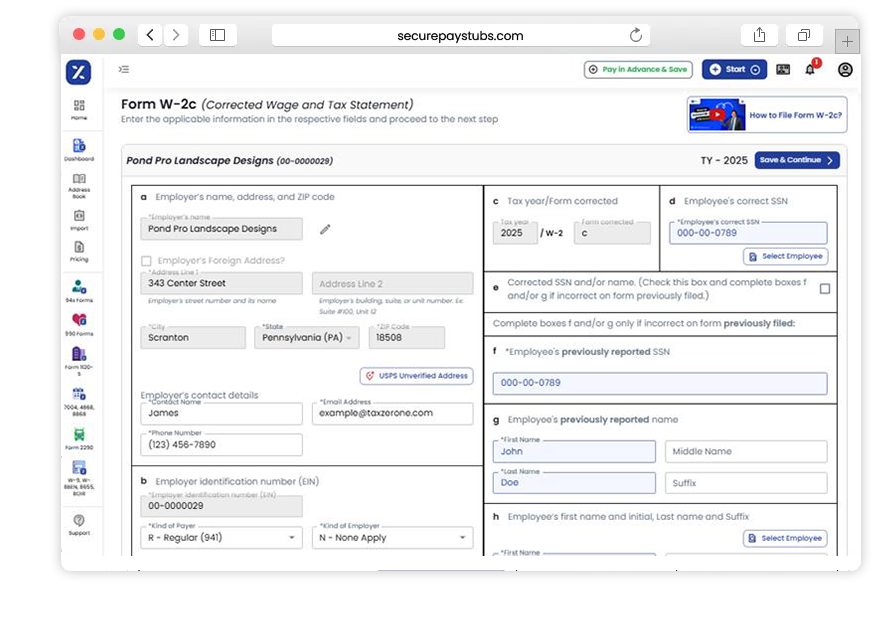

Enter Corrected Details

Add your business EIN, employee information, and corrected wage and tax amounts.

Review and E-File

Validate your data with built-in IRS error checks, then securely submit your W-2C form online.

Distribute Employee Copies

Instantly deliver corrected W-2C copies to employees electronically or by mail.

What You’ll Need to File Form W-2C

Prepare these details before you e-file:

Employer Information: Business name, EIN, and address

Employee Information: Name, SSN, and address

Corrected Wage Details: Federal and state wages, taxes withheld, and Medicare/Social Security data

State Tax Information: State ID number, wages, and income tax corrections

Who is TaxZerone?

TaxZerone is an IRS-authorized e-file provider that helps businesses and individuals file tax forms online safely and efficiently. This platform is created by the same trusted team behind SecurePayStubs.

We support employment tax forms, excise filings, information returns, extensions, and more — making tax compliance easy and error-free.

Our trusted partner, TaxZerone, ensures a seamless, secure, and reliable filing experience every time.

Why Choose TaxZerone for Form W-2c E-filing?

TaxZerone is the trusted e-filing solution for businesses of all sizes. Here’s why:

IRS-Authorized Filing

Securely e-file your Form W-2c with full compliance to IRS regulations and standards.

Bulk Upload Support

Easily upload and file multiple W-2c forms at once, saving valuable time and effort.

Step-by-Step Guided Filing

Follow clear on-screen instructions and prompts that guide you through every stage of the e-filing process.

Employee Copy Distribution

Safely share employee copies through a secure online portal for electronic delivery, or choose postal mailing for physical copies.

Fast and Accurate Filing

Submit W-2c corrections in just minutes with a simple, step-by-step workflow to stay accurate and compliant.

Affordable Pricing

Access competitive, volume-based pricing that helps you manage costs effectively while maintaining high-quality filing service.

File Your W-2C Forms Fast and Hassle-Free!

Start correcting your wage and tax statements now. E-file Form W-2C online with TaxZerone to stay compliant and error-free.

Start W-2c Correction now