What Are Local Taxes?

Local taxes are payroll taxes imposed by cities, counties, or local jurisdictions in addition to state and federal taxes. They vary by location and are required in certain states.

Which States Require Local Taxes?

Local taxes are payroll taxes imposed by cities, counties, or local jurisdictions. They apply only in certain

states and vary by location.

- Alabama

- Colorado

- Delaware

- Kentucky

- Indiana

- Maryland

- Michigan

- Missouri

- New York

- Ohio

- Pennsylvania

- West Virginia

Why SecurePayStubs Is the Smart Choice for Small Businesses

See how SecurePayStubs makes paystub creation simple, accurate, and stress-free for small businesses.

Accurate Tax Calculations

Automatically handles local, state, and federal taxes with zero errors.

Fast & Simple Paystub Creation

Generate professional paystubs in minutes with just a few clicks.

Clear Earnings Breakdown

Each paystub clearly shows gross pay, deductions, and net pay.

Saves Valuable Time

Automates calculations so you can focus on running your business.

Affordable & Transparent Pricing

No hidden charges, no subscriptions—just pay for what you need.

Secure & Confidential

All information is encrypted to keep your business data safe.

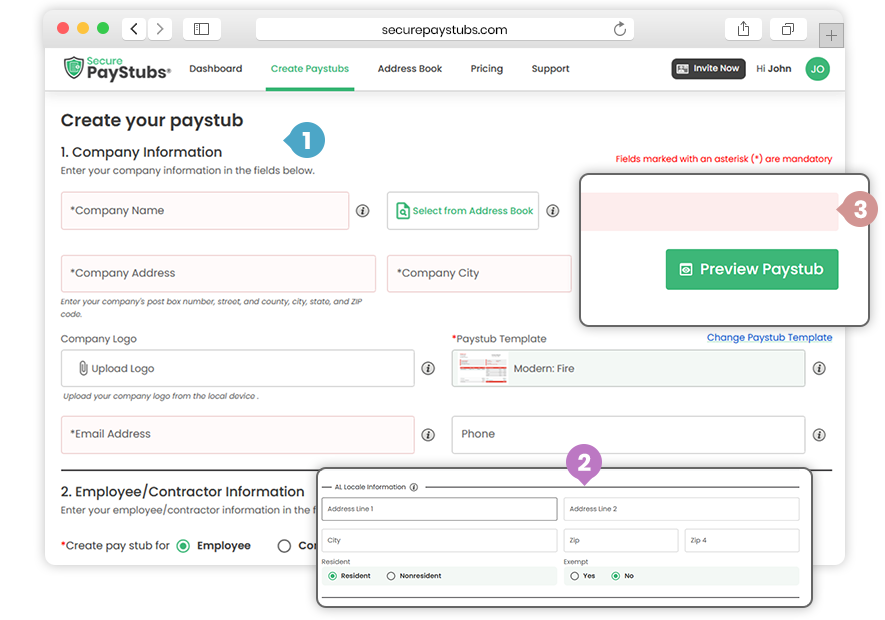

How to Create Your Paystub with Accurate Local Tax Calculations

Follow these simple steps to generate professional, compliant paystubs in minutes.

- 1

Enter Basic Details

Add your company and employee information — including location details — to ensure accurate local tax identification.

- 2

Auto-Detect Local Taxes

Our system automatically calculates the correct city, county, or municipal taxes based on the address entered.

- 3

Generate Accurate Paystub

Preview and download your paystub with all local tax deductions perfectly applied and ready for recordkeeping.

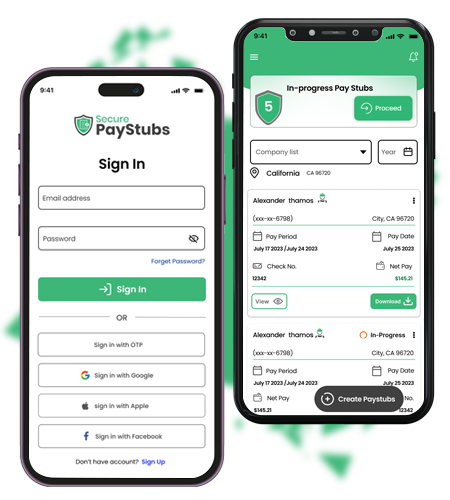

Manage Local Tax Calculations Anytime, Anywhere

Download the SecurePayStubs App for On-the-Go Payroll Accuracy

Create, preview, and download paystubs with precise local tax details — directly from your phone. Whether you’re at the office or on the move, the SecurePayStubs app keeps your payroll accurate and compliant at all times.