Why Multi-State Tax Calculation Matters

When employees work from different states, payroll becomes complex. Each state

has its own tax rules, and mistakes can lead to penalties or unhappy employees.

Accurate multi-state tax calculation ensures every pay stub is correct

and compliant — no matter where your team works.

Why Choose SecurePayStubs for Multi-State

Payroll Tax Calculation

Below are the top reasons why small businesses trust SecurePayStubs to handle their remote payroll

and stay compliant with ease.

Automatic Tax Calculations

Automatically applies accurate federal, state, and local tax rates based on each employee’s work location.

Compliance with Tax Rules for All 50 States

Supports all 50 state-specific tax rules, including reciprocal agreements and special local mandates. —no manual research is needed.

Real-Time Tax Rate Updates

Tax tables and rules are updated regularly so that your calculations always reflect the latest tax laws.

One-Click Pay Stub Generation

Create accurate, multi-state compliant pay stubs in seconds. Use‘Create Next Pay Stub’ to auto-fill past data and speed up future stub creation.

Easy Employee Address Book

Store and manage multiple employee addresses to ensure tax calculations are based on the correct work location.

Instant Download/ Email Delivery

Easily download or email pay stubs to simplify payroll for remote and multi-state teams.

Security and Privacy

Your payroll data stays safe with top-tier encryption and secure storage, ensuring full confidentiality and compliance.

Designed for Remote Employee Payroll

Easily manage payroll across states with accurate tax rules based on where employees live and work.

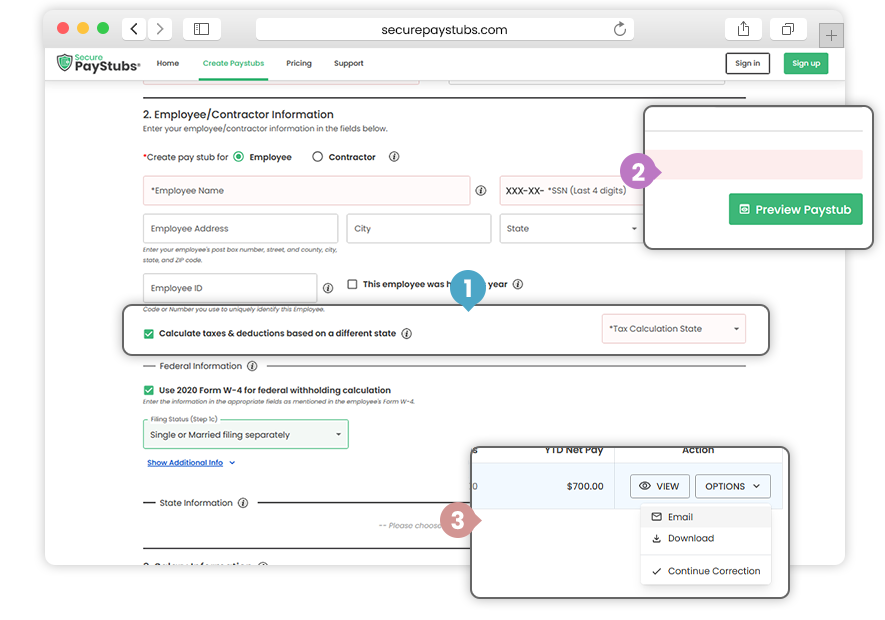

How Our Multi-State Tax Calculation Feature Works

Generate accurate pay stubs in 3 simple steps—perfect for small businesses with remote teams.

- 1

Enter Details & Select Work State

Fill in employer and employee information. In the Employee Information section, tick the checkbox to set the correct work location.

- 2

Preview Pay Stub

View an instant preview with accurate federal and state tax calculations based on the selected state.

- 3

Download Pay Stub

Download a compliant, ready-to-use pay stub in just one click.

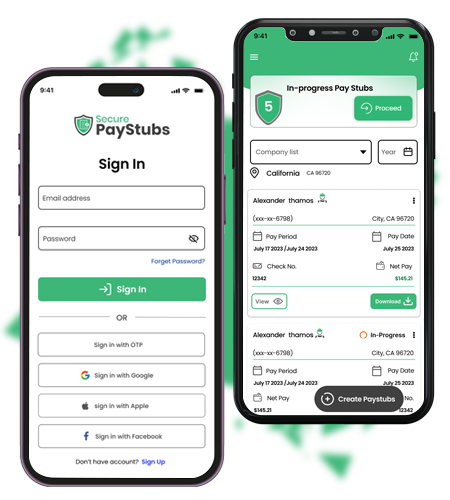

Download the SecurePayStubs App for Effortless

Multi-State Payroll

SecurePayStubs: The Trusted Solution for Multi-State Remote Employee Pay Stubs!

Quickly generate accurate, state-compliant pay stubs for remote employees working across different

states—all in one simple platform.

What Real Users Are Saying

Thousands of small business owners trust SecurePayStubs to simplify remote payroll across state lines. Here’s what a few of them had to say:

I have a small team working in different states, and I always worried about getting taxes right. This tool made it super easy. I just enter the details, and it handles the rest. So glad I found it!

Rachel P.

Small Business Owner

We started hiring out-of-state workers recently, and I wasn’t sure how to deal with the taxes. This pay stub generator figured it all out for me. It’s simple and saves me a lot of time.

Neha S.

Freelance Team Lead