What is Time-Off?

Time-off refers to the paid or unpaid hours employees take away from work, including vacation days, sick leave, personal time, and other absences.

Why It Matters on Pay Stubs

Showing time-off directly on pay stubs gives employees a clear view of how much leave they’ve earned and used. For employers, it reduces confusion, supports compliance with state regulations, and builds trust through transparency.

Key Advantages of Adding Time-Off to Pay Stubs

Below are the key advantages of adding time-off information to pay stubs. See how it helps your business stay compliant, transparent, and efficient.

Compliance – Automatically meet state PTO, sick leave, and vacation regulations.

Transparency – Employees see exactly how much time off they’ve earned and used.

Save Time – Reduce HR questions and administrative work.

Accuracy – Eliminate manual errors in tracking and reporting.

Trust & Morale – Boost employee confidence with clear, professional pay stubs.

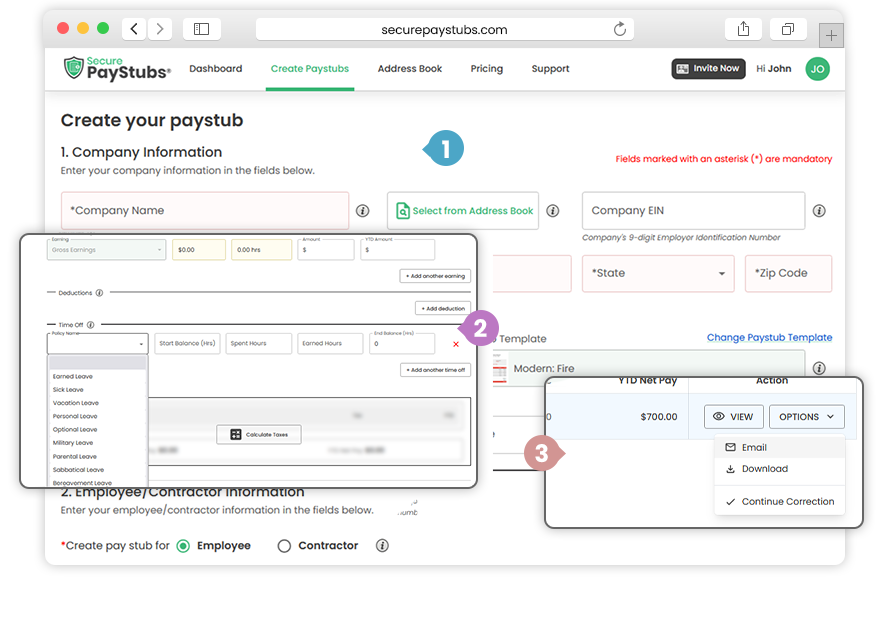

How to Add Time-Off Info to Pay Stubs

With SecurePayStubs, adding leave details is fast, accurate, and effortless. Follow these 3 simple steps to get started:

- 1

Enter All Essential Details

Fill in business, employee, salary, and tax information as usual.

- 2

Add Time-Off in the Salary Section

Go to the Salary section, select the time-off policy (PTO, vacation, or sick leave), and enter accrued and used hours.

- 3

Generate, Download, or Email

Preview the pay stub—time-off balances are automatically calculated and displayed, then download it or email it directly to your employee.

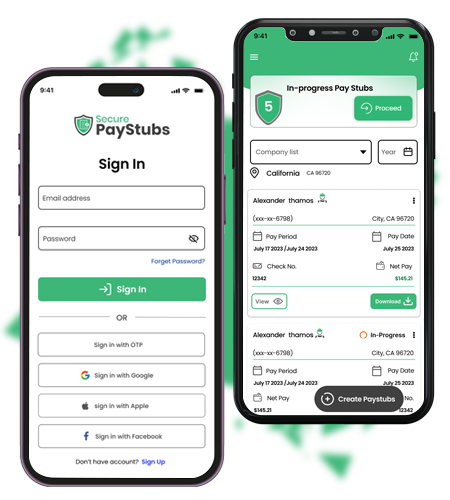

Download the SecurePayStubs App with Built-In Time-Off Tracking

Manage PTO, Vacation, Sick Leave & More — All in One Place.

Available on Android, iPhone, and iPad. No more spreadsheets or tracking mistakes. With SecurePayStubs, each employee’s time-off balance updates automatically and shows clearly on their pay stubs. Save time, reduce errors, and keep your team informed.