Try Before You Buy — First Paystub FREE

Use promo code FIRSTSTUB to generate your first paystub with no cost,

and no subscription—just simple, seamless paystub creation.

Quick Facts:

Just 2 minutes to generate a paystub

Built for Small Businesses, Freelancers & Startups

IRS-compliant with automatic tax & YTD calculations

Instant PDF download — ready to email or print

Why Choose SecurePayStubs?

Small Business Payroll? We’ve Made It Simple.

1. No Payroll Software Required

No logins, no setup. Just enter the details and generate your paystub.

2. Secure & Accurate

Taxes are calculated based on the latest federal and state guidelines.

3. Instant PDF Download

Email or print paystubs immediately for your records.

Small business owners love us because we eliminate complexity. Whether you’re paying a part-time employee or a full-time contractor, we’ve got your back.

How SecurePayStubs Works

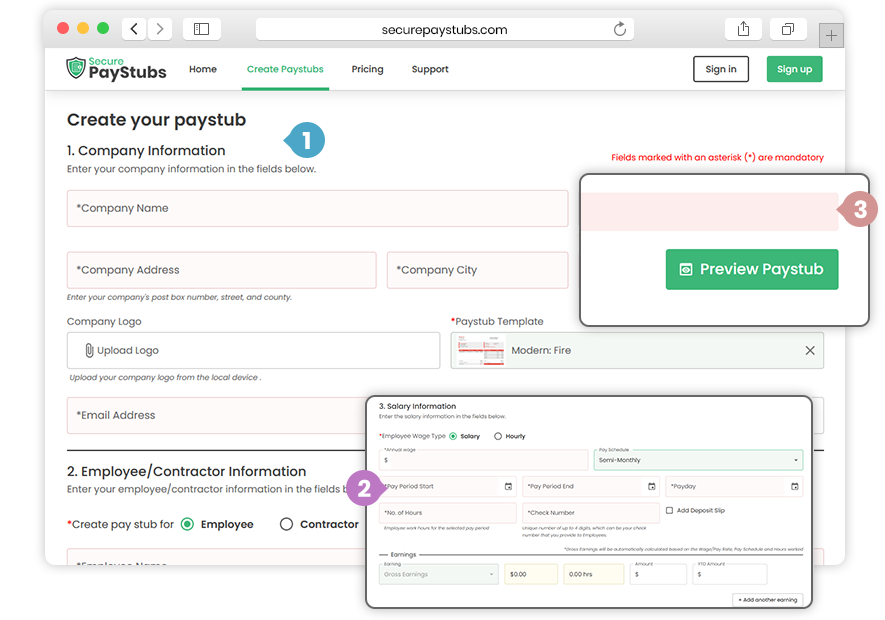

Create a Paystub in Just 3 Simple Steps

- 1

Fill in Employer & Employee Details

Business name, employee info, job title, and address.

- 2

Enter Payment Information

Hours worked, pay rate, pay date, deductions, and taxes.

- 3

Preview & Download Instantly

View your paystub, make edits if needed, and download it as a PDF.

Need to create another stub for the same employee? Just click “Create Next Paystub” to reuse saved details and save time.

Features for Small Business Needs

What Makes Our Paystub Generator Stand Out?

Designed for Simplicity

Supports Weekly, Biweekly, Semimonthly, Monthly Pay

Auto Tax & Deduction Calculation

Paystub Ready for Direct Deposit

YTD Earnings & Deductions Display

Supports 1099 Contractors & W-2 Employees

Professional Templates to Match Your Brand

Store & Access Paystubs Anytime

One-Click “Create Next Paystub” Creation

Who Can Use This Tool?

Whether You Have 1 Employee or 50—We’re Here for You

- Handyman & Home Services

- Boutique & Retail Store Owners

- Restaurants & Local Cafés

- Freelancers & Creative Agencies

- Delivery Teams & Gig Workers

- Construction & Skilled Trade Businesses

If you pay someone for work, you need to give a paystub. SecurePayStubs makes it quick and painless.

Real Reviews from Small Business Owners

100+ Verified Reviews from Business Owners Like You

Small business owner

— James R

Salon Owner

— Anjali M

Local Café Manager

— Mike T