What Does Year to Date (YTD) Mean?

YTD shows total earnings, deductions, and taxes from the start of the year to the current pay period .

It helps track cumulative pay, ensures payroll accuracy, and builds employee trust.

YTD Totals for W-2s and 1099s

YTD pay stubs aren’t just for tracking income—they’re essential for accurate tax reporting.

W-2 Employees: Ensure wages, taxes, and deductions align with year-end W-2 forms.

1099 Contractors: Track total compensation for easy and accurate 1099 - NEC filing.

With SecurePayStubs, every pay stub is tax-ready, saving small businesses time and avoiding costly errors at year-end.

Why Small Businesses Love SecurePayStubs for YTD Pay Stubs

Fast, Accurate, and Professional—Every Time

SecurePayStubs lets small businesses create accurate, compliant YTD pay stubs in seconds, building trust

and professionalism with every employee.

Instant YTD Calculations

Track cumulative earnings, deductions, and taxes automatically, giving you accurate totals without manual work.

Boost Employee Confidence

Provide employees with transparent pay stubs that clearly show cumulative earnings and deductions, building trust and reducing payroll disputes.

Effortless Compliance

Stay compliant with federal and state requirements by keeping accurate YTD reporting, making audits and tax season stress-free.

Affordable for Small Businesses

Enjoy professional YTD pay stubs at just $2.99 per stub—making it the most cost-effective solution without compromising quality.

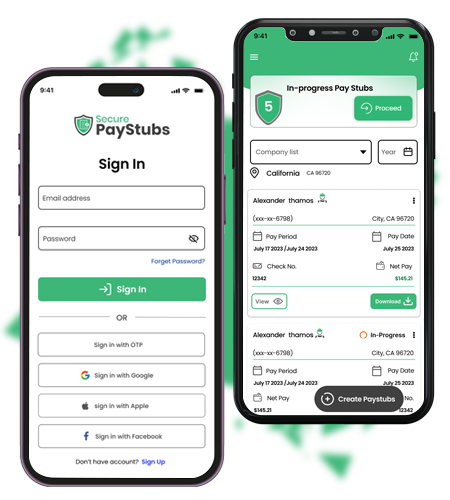

Anytime, Anywhere Access

Generate, download, and share YTD pay stubs from any device—whether you’re in the office or on the go.

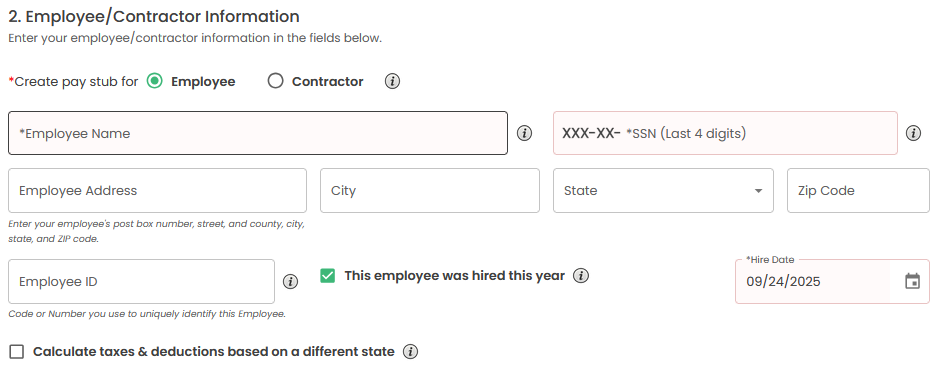

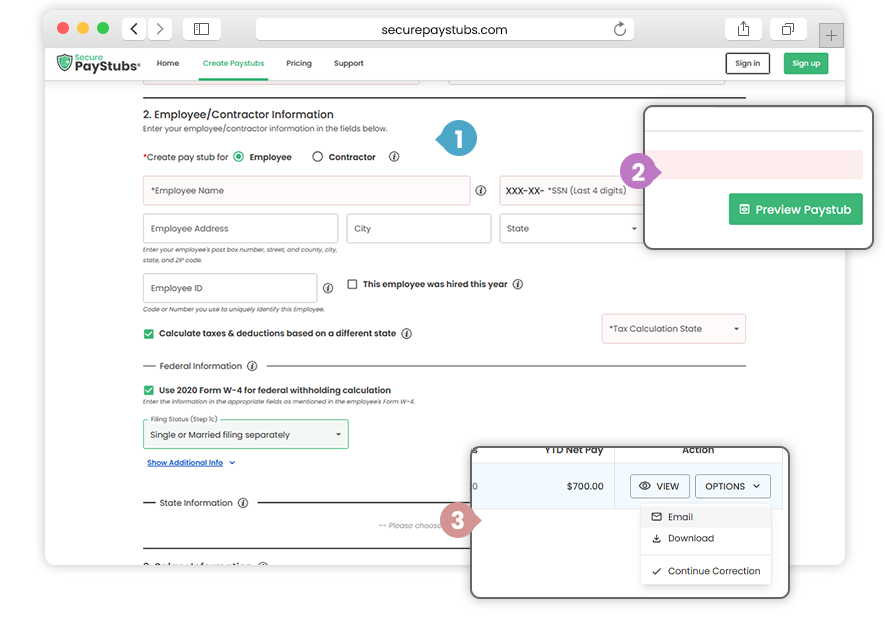

How It Works: Generate YTD Pay Stubs in 3 Simple Steps

From details to download—create professional YTD pay stubs in minutes, with accurate totals and zero hassle.

- 1

Enter Required Details

Fill in employer, employee, and salary information to get started.

- 2

Preview Instantly

Review accurate YTD earnings, deductions, and taxes before finalizing.

- 3

Download or Email

Get your professional pay stub instantly, ready to print or share.

Download the SecurePayStubs App for Instant YTD

Pay Stub Generation

Create Professional YTD Pay Stubs — Anytime, Anywhere

Generate Your YTD Pay Stubs in Seconds

Create professional, accurate YTD pay stubs in seconds—fast, easy, and

hassle-free for small businesses.

Saves Time

First Stub Free

Instant Download & Email

Frequently Asked Questions

1. What does YTD mean on a pay stub?

2. How to calculate year-to-date income?