Create Your Paystub in 3 Easy Steps

- 1. Provide Information

- 2. Preview Paystub

- 3. Download Stub!

Understanding 401(k) contribution limits for 2025 and 2026 is essential for both employees planning their retirement and employers managing compliant payroll records. Each year, the IRS adjusts these limits to account for inflation, and staying informed helps maximize tax advantages while avoiding costly mistakes. This guide explains the latest 401(k) limits, catch-up contributions, employer matching rules, and payroll considerations, helping both employees and businesses make informed decisions.

This article has been updated from its original publication date of January 03, 2026.

Table of Contents

Why 401(k) Contribution Limits Matter

For Employees:

- Contribution limits determine how much money can legally be saved in a retirement plan each year.

- Saving up to the maximum allowed helps grow retirement savings faster.

- Contributions also reduce taxable income, providing immediate tax benefits.

For Employers:

- Limits are essential for accurate paystub reporting and payroll compliance.

- A clear display of retirement deductions on earning statements builds employee trust.

401(k) Contribution Limits for 2025 and 2026

The IRS sets separate limits for:

- Employee elective deferrals

- Catch-up contributions (age-based)

- Total combined contributions (employee + employer)

These limits typically increase every few years due to inflation adjustments.

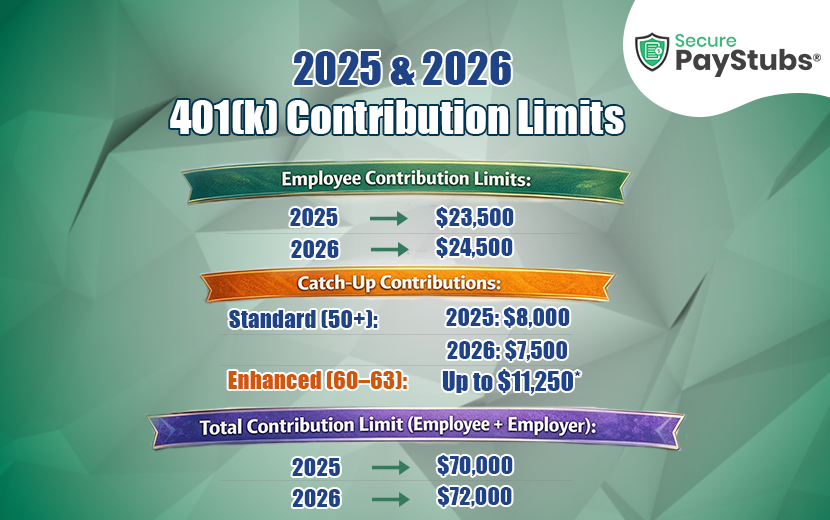

Employee Contribution Limits

| Year | Employee Contribution Limit |

|---|---|

| 2025 | $23,500 |

| 2026 | $24,500 |

Employees can contribute to these amounts through pre-tax (Traditional 401(k)) or after-tax (Roth 401(k)) contributions, or a combination of both.

Catch-Up Contributions for Older Employees

Catch-up contributions allow older workers to save more as they approach retirement.

Standard Catch-Up (Age 50+)

| Year | Catch-Up Limit |

|---|---|

| 2025 | $8,000 |

| 2026 | $7,500 |

Enhanced Catch-Up (Ages 60–63)

Under SECURE Act 2.0, employees aged 60 to 63 may qualify for a higher catch-up contribution, significantly boosting late-career retirement savings.

| Year | Enhanced Catch-Up Limit |

|---|---|

| 2025 | Up to $11,250* |

| 2026 | Up to $11,250* |

*Subject to IRS inflation indexing and plan eligibility.

Total 401(k) Contribution Limits (Employee + Employer)

The IRS also caps the total annual contribution, including:

- Employee deferrals

- Employer matching contributions

- Employer profit-sharing contributions

| Year | Total Contribution Limit |

|---|---|

| 2025 | $70,000 |

| 2026 | $72,000 |

This higher cap is especially important for employers offering generous matching or profit-sharing plans.

Employer Matching: What Businesses Should Know

Employer matching contributions:

- Do not count toward the employee’s individual deferral limit

- Do count toward the total annual contribution limit

For example, if an employee contributes $24,500 in 2026, the employer can still add matching funds as long as the combined total stays within IRS limits.

Highlight 401(k) Contributions on Paystubs

Make retirement contributions clear and transparent for employees while maintaining accurate payroll records.

Traditional vs Roth 401(k): Contribution Limits Are the Same

Whether employees choose:

- Traditional 401(k) (pre-tax, taxable at withdrawal), or

- Roth 401(k) (after-tax, tax-free withdrawals), …the IRS contribution limits remain the same. The difference lies in when taxes are paid, not how much can be contributed.

Payroll and Paystub Compliance for Employers

Accurate 401(k) reporting is essential for:

- Payroll accuracy

- IRS compliance

- Employee financial clarity

Employers should ensure:

- Contributions are correctly deducted each pay period

- Employer matches are properly recorded

- 401(k) deductions are clearly displayed on paystubs

Platforms like SecurePayStubs help employers highlight retirement contributions directly on employee paystubs, making it easier for workers to track their savings and for businesses to stay compliant.

What Happens If Contribution Limits Are Exceeded?

Excess contributions can result in:

- IRS penalties

- Additional taxes

- Required corrective distributions

Employees should monitor contributions closely, especially if they:

- Change jobs mid-year

- Have multiple employers

- Receive large bonuses

Employers can reduce errors by maintaining accurate payroll documentation and paystub records.

Final Thoughts

The 2025 and 2026 401(k) contribution limits offer employees more opportunities to grow retirement savings and give employers a chance to enhance benefit offerings. Staying informed helps both sides maximize tax advantages, avoid penalties, and maintain clear financial records.

Whether you’re contributing to a plan or managing payroll, understanding these limits is essential for smart retirement planning and accurate paystub reporting.