Create Your Paystub in 3 Easy Steps

- 1. Provide Information

- 2. Preview Paystub

- 3. Download Stub!

In today's fast-paced world, remote working has become normal. Many business owners like you are hiring top talent from anywhere and offering a remote job, but managing payroll for such employees involves a complex task: multi-state payroll.

In the US, each state has its own tax laws, different compliance rules, and wage requirements. For small businesses without an HR team, handling multi-state payroll can lead to tax confusion, time-consuming manual calculations, costly penalties, unhappy employees, or audits.

So that's why SecurePayStubs is here to help you manage multi-state payroll without any stress. If you have any remote employees or, in the future, if you are going to hire any remote employees for your business, you don’t need to worry about multi-state payroll taxes, as SecurePayStubs handles all calculations for you.

Let's see how SecurePayStubs can simplify the entire process.

Table of Contents

- What Is Multi-State Payroll?

- Why Is Multi-State Payroll Complex for Small Businesses?

- What Happens If You Get It Wrong?

- How SecurePayStubs Solves the Multi-State Payroll Challenge

- Step-by-Step: How to Use SecurePayStubs for Multi-State Payroll

- Benefits for Small Business Owners

- Real-World Employer Experiences

- Key Takeaways

What Is Multi-State Payroll?

Multi-state payroll refers to the process of managing employee wages, taxes, and reporting when your workforce is spread across different U.S. states. This applies if:

- Your employee lives in one state and works in another

- Your business is registered in one state, but hires talent elsewhere

- Employees work remotely, relocate between states, or join hybrid teams.

- You have a hybrid or distributed team

In these situations, payroll must be tailored to match state-specific rules — including income tax rates, local contributions, and registration requirements.

Why Is Multi-State Payroll Complex for Small Businesses?

Large enterprises often have HR departments and payroll experts, but small business owners often manage these processes themselves. Here’s why multi-state payroll presents challenges:

1. Varying State Tax Laws

Some states have no income tax (like Florida or Texas), while others have progressive tax systems (like California or New York). Withholding requirements differ in every state.

2. Local and City Taxes

Certain cities or municipalities add additional taxes (e.g., New York City or Denver), which must be reflected in payroll.

3. State Registration Requirements

Employers may need to register for payroll taxes in any state where an employee performs work — even if they have no physical office there.

4. Reciprocity Agreements

Some neighboring states (like Maryland and Virginia) have agreements that affect tax withholding rules for cross-border employees.

5. Wage & Labor Law Variations

Minimum wage, overtime rules, and benefits vary by state. Businesses must comply with each applicable jurisdiction.

What Happens If You Get It Wrong?

Mistakes in multi-state payroll can result in:

- Penalties from underpayment or late filing of taxes

- Employee dissatisfaction due to incorrect net pay

- Time-consuming audits or correction procedures

- Reputational damage to your business

That’s why it's critical to use a tool that eliminates guesswork and automates compliance.

How SecurePayStubs Solves the Multi-State Payroll Challenge

SecurePayStubs is built with small businesses in mind. Our pay stub generator includes multi-state support, so you can confidently handle payroll for employees in any U.S. state — without hiring outside payroll providers.

- Automatic Tax Calculations

Our system automatically applies the correct state and local income tax rates based on the employee's work and residence location. - Real-Time Compliance Updates

You don’t need to track changing laws — we keep tax rates and payroll regulations updated across all 50 states. - Streamlined Pay Stub Creation

Enter your employee's information once, and generate professional, compliant pay stubs in seconds. - Ideal for Remote, Hybrid, and Contract Workers

Whether you’re paying full-time remote employees or independent contractors in different states, SecurePayStubs adapts to your payroll structure.

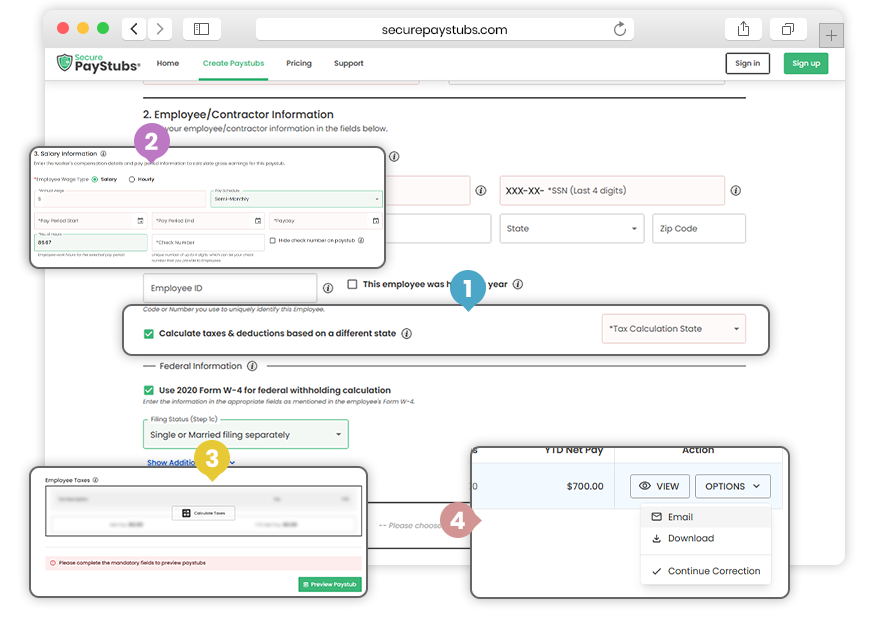

Step-by-Step: How to Use SecurePayStubs for Multi-State Payroll

- Select the Employee's State

In the Employee Information section, choose the correct residence and work state. - Enter Pay Information

Fill in gross pay, pay schedule, and pay period in the Salary Information section. - Let the System Calculate Deductions

SecurePayStubs automatically applies federal, state, and local tax deductions based on the states entered. - Preview and Download the Pay Stub

Review all earnings and deductions before downloading or sending it directly to the employee.

Benefits for Small Business Owners

- Save time by eliminating manual tax research

- Avoid costly errors and compliance issues

- Provide employees with accurate, professional pay stubs

- Maintain flexibility as your team expands across states

- No subscriptions — only pay when you need to generate a stub

Real-World Employer Experiences

See how businesses across industries simplify payroll and stay compliant.

We started hiring out-of-state designers, and the tax rules were overwhelming. SecurePayStubs automatically handled it all — no spreadsheets or guesswork.

Jason P.

Creative Agency Owner

Even with contractors in five different states, I’m able to generate accurate pay stubs with just a few clicks.

Meera D.

Tech Startup Founder

Key Takeaways:

- Multi-state payroll requires handling different tax laws, registrations, and labor rules by state.

- You must withhold taxes based on where employees work, not where your business is based.

- Mistakes can lead to penalties, audits, or employee dissatisfaction.

- SecurePayStubs auto-calculates state and local taxes, helping you stay compliant.

- It’s built for small businesses with remote or hybrid teams — no subscriptions, just pay-per-stub.

Ready to Take the Stress Out of Multi-State Payroll?

Don’t let complex tax rules slow your business down. With SecurePayStubs, you can handle multi-state payroll like a pro — no spreadsheets, no second-guessing, and no need to hire an expert.

Join thousands of small business owners who trust SecurePayStubs to stay compliant, save time, and pay remote employees the right way — every time.

This article was last updated on February 09, 2026.