Create Your Paystub in 3 Easy Steps

- 1. Provide Information

- 2. Preview Paystub

- 3. Download Stub!

Introduction:

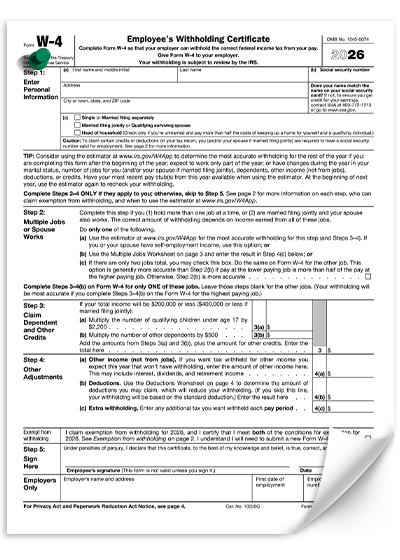

Form W-4, which is also called the “Employee's Withholding Certificate,” helps employers how much federal income tax to take out of workers' paychecks.

For Employers, it's important to understand Form W-4. It ensures that IRS rules are followed, taxes are withheld correctly, and handling paystubs goes smoothly.

This guide explains what Form W-4 is, how it works, and what businesses need to do to follow the rules and help their employees.

Table of Contents

What is a W-4 Form?

Form W-4, also called the Employee’s Withholding Certificate, is an IRS-required form that employees must fill out and give to their employer. It provides businesses how much federal income tax to take out of each employee's paycheck.

When Form W-4 is filled out correctly:

- Employees avoid underpaying or overpaying taxes

- Employers withhold the correct amount of federal income tax

- Payroll and paystubs stay accurate and IRS-compliant

Key Sections of Form W-4

Form W-4 has been divided into several parts. They all have an impact on how the federal income tax is determined.

1. Personal Information

Employees provide:

- Full legal name

- Address

- Social Security number (SSN)

Employers can use this information to correctly identify the worker in payroll records.

2. Filing Status

Employees must select one filing status on Form W-4:

- Single or Married Filing Separately

- Married Filing Jointly

- Head of Household

The chosen filing status affects:

- Tax brackets

- Standard deductions

- Amount of tax withheld

3. Multiple Jobs or Working Spouse

This section applies if:

- he employee has more than one job, or

- Their spouse also earns income

Completing this section helps prevent under-withholding or over-withholding taxes.

4. Dependents and Other Credits

Employees report dependents and other tax credits:

- Qualifying children under 17: multiply by $2,200

- Other dependents: multiply by $500

- Add any other credits

This helps reduce withholding eligible tax credits.

5. Other Adjustments

The workers can make further adjustments:

- Other income: interest, dividends, retirement income

- Deductions: above standard deduction

- Extra withholding: additional tax per pay period

6. Signature and Date

The workers can make further adjustments:

- The form is valid only when signed and dated.

- The signature confirms that the information is accurate.

Why Form W-4 Is Important

Form W-4 ensures accurate federal income tax withholding.

For Employees

- Helps employees avoid paying too much or too little tax during the year

- Prevents unexpected tax bills at tax time

- Reduces the chance of receiving large, unexpected refunds

For Employers

- Ensures accurate federal income tax withholding from employee paychecks

- Keeps the company compliant with IRS regulations

- Helps maintain correct payroll and tax records

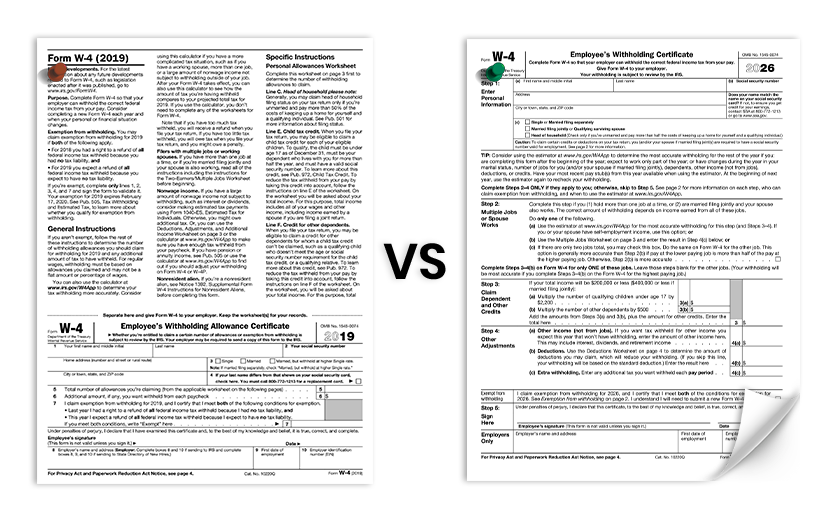

2020 and Later W-4 Updates: Pre- vs. Post-2020

| Feature | Pre-2020 W-4 | Post-2020 W-4 |

|---|---|---|

| Allowances | Employees claimed allowances to adjust withholding | Allowances removed |

| Withholding Basis | Based mainly on allowances and filing status | Based on filing status, dependents, other income, and adjustments |

| Employees Hired Before 2020 | Could continue using old W-4 | Not required to submit a new W-4 unless updating withholding |

Key Takeaway: The 2020 redesign simplifies withholding calculations and removes allowances, making tax withholding more accurate.

Employee Responsibilities

Employees must:

- Complete Form W-4 accurately

- Submit it during onboarding

- Update it after life changes such as:

- Marriage or divorce

- Birth of a child

- Second job

- Major income changes

Employees can use the IRS Tax Withholding Estimator for guidance.

Employer Responsibilities

Employers are responsible for proper W-4 handling.

Employer duties include:

- Giving new hires Form W-4

- Collecting completed forms

- Storing W-4 records securely

- Updating payroll systems

- Withholding correct federal income tax

- Reflecting W-4 data accurately on paystubs

Failure to follow these steps may result in IRS penalties.

How Employers Can Assist Employees

Employers can help their workers by:

- Describe how Form W-4 works

- Sharing tools and information from the IRS

- Encouraging updates after life changes

- Suggesting professional tax advice when needed

Clear guidance helps prevent payroll issues later.

Conclusion:

Form W-4 plays a critical role in payroll accuracy and tax compliance. By understanding how the form works and staying updated on IRS changes, employers can:

- Ensure correct tax withholding

- Reduce payroll errors

- Support employees effectively

Keeping track of W-4 forms and paystubs is easy, correct, and stress-free with tools like SecurePayStubs.

Simplify your paystub process with SecurePayStubs!

Our paystub generator platform offers an option to give Form W-4 details, both pre-2020 and 2020 changes, making paystub detailing easy and precise. Here’s how we can help:

- Easy Information Entry: Quickly input employee details, and give W-4 information pre- 2020 and 2020, for accurate paystub calculations.

- Automatic Calculations: Accurate federal tax deductions with no manual work

- Comprehensive Pay Stubs: Clear earnings and deductions that follow IRS rules

- Compliance and Transparency: Supports both old and new W-4 structures

Make paystub management effortless with SecurePayStubs. Start using our platform today to simplify your paystub process while accommodating W-4 changes seamlessly!

This article was last updated on February 2, 2026.