Create Your Paystub in 3 Easy Steps

- 1. Provide Information

- 2. Preview Paystub

- 3. Download Stub!

Introduction

A 401(k) is a key retirement savings plan that helps employees secure their financial future. With tax advantages and potential employer contributions, it encourages consistent saving and long-term growth.

In this guide, we explain what a 401(k) is, how a 401(k) works, the different types of plans, key features, benefits, contribution limits, and how employers can clearly display contributions on paystubs using SecurePayStubs.

This article has been updated from its original publication date of January 03, 2026.

Table of Contents

what is a 401k?

A 401(k) is an employer-sponsored retirement savings account that allows employees to contribute a portion of their income toward retirement. Contributions may be:

- Pre-tax (Traditional 401(k)) – reduces current taxable income; taxes are paid on withdrawals.

- After-tax (Roth 401(k)) – contributions are taxed upfront; withdrawals are tax-free in retirement.

- Employer Match: Many employers add a percentage of contributions, helping employees save faster.

How Does a 401(k) Work?

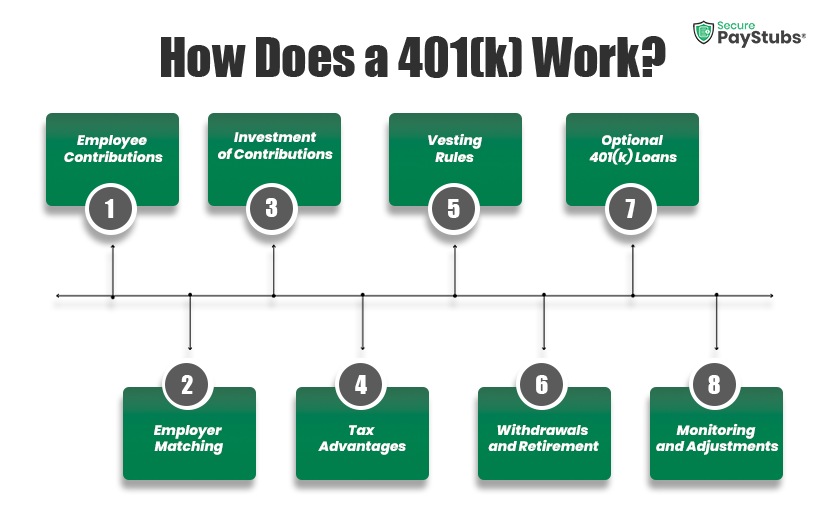

A 401(k) is a retirement savings plan that allows employees to save and invest a portion of their salary with tax advantages. Employer contributions may also be added to boost savings. The plan operates in the following steps:

- Step 1: Employee Contributions

A portion of an employee’s paycheck is allocated to the 401(k) account, either pre-tax (Traditional) or after-tax (Roth), depending on the plan type. - Step 2: Employer Matching

Employers often provide matching contributions, adding a percentage of employee contributions to the account to accelerate retirement savings. - Step 3: Investment of Contributions

Contributions are invested in plan-approved options, such as mutual funds, index funds, or company stock, allowing the balance to grow over time. - Step 4: Tax Advantages

Traditional contributions reduce current taxable income, while Roth contributions grow tax-free and withdrawals in retirement are not taxed. - Step 5: Vesting Rules

Employee contributions are fully vested. Employer contributions may follow a vesting schedule, granting full ownership after a defined period of employment. - Step 6: Withdrawals and Retirement

Funds can generally be withdrawn penalty-free after age 59½. Early withdrawals may incur a 10% penalty plus applicable taxes. - Step 7: Optional 401(k) Loans

Some plans allow loans against the account balance, which must be repaid with interest; unpaid loans may be treated as taxable distributions. - Step 8: Monitoring and Adjustments

Regular review of contributions, employer matches, and investment performance helps ensure alignment with retirement objectives.

Types of 401(k) Plans

401(k) plans come in different types to suit various employees and employers. Each type has unique features, benefits, and rules. Here’s a clear breakdown:

| Plan Type | Best For | Contribution Type | Key Features / Benefits |

|---|---|---|---|

| Traditional 401(k) | Most employees | Pre-tax | Contributions reduce taxable income now; taxes paid on withdrawals in retirement. |

| Roth 401(k) | Employees expecting higher taxes in retirement | After-tax | Contributions are made after-tax; qualified withdrawals (including earnings) are tax-free. |

| Safe Harbor 401(k) | Employers avoiding IRS non-discrimination tests | Pre-tax + employer contributions | Employer contributions are fully vested immediately; helps meet compliance rules easily. |

| Solo 401(k) (Individual 401(k)) | Self-employed / business owners with no full-time employees (except spouse) | Pre-tax or Roth | Higher contribution limits; flexible investment options; ideal for maximizing retirement savings. |

| SIMPLE 401(k) | Small businesses (≤100 employees) | Pre-tax + mandatory employer contributions | Easier administration; combines employee and employer contributions; encourages consistent savings. |

Key Features of a 401(k)

It provides an overview of the essential elements of a 401(k) retirement savings plan, including tax-deferred contributions, employer matching contributions, contribution limits, investment options, vesting rules, withdrawal penalties, required minimum distributions, and loan provisions.

1. Tax-Deferred Contributions

- Contributions come from pre-tax income, reducing your taxable income for the year.

- Taxes on contributions and earnings are deferred until withdrawal in retirement.

- Helps employees grow their savings faster through tax-deferred investment growth.

2. Employer Matching Contributions

- Many employers match a portion of your contributions, e.g., 50% of contributions up to a set percentage of your salary.

- This is essentially free money added to your retirement savings.

- Encourages consistent savings and helps employees reach retirement goals faster.

3. Contribution Limits

- There is a maximum annual contribution for employees set by the IRS.

- Employees aged 50 and older can make catch-up contributions for additional retirement savings.

- Combined employee and employer contributions cannot exceed the total annual contribution limit.

4. Investment Options

- 401(k) plans usually offer mutual funds, index funds, target-date funds, and company stock.

- Employees can choose investments based on their risk tolerance, time horizon, and retirement goals.

5. Vesting

- Vesting refers to the ownership of employer contributions.

- Some plans have immediate vesting, while others require you to stay with the company for a certain period before you can take full ownership of the employer's contributions.

6. Withdrawals and Penalties

- Withdrawals before age 59½ usually incur a 10% early withdrawal penalty plus regular income tax.

- Some exceptions exist (medical expenses, disability, etc.).

7. Required Minimum Distributions (RMDs)

- RMDs must begin by April 1 following the year you turn 73 (born 1951–1959) or 75 (born 1960+).

8. Loan Provisions

- Some plans allow employees to borrow from their 401(k).

- Loans must be repaid with interest, or they may be considered taxable distributions.

Highlight 401(k) Contributions on Employee Paystubs with SecurePayStubs

Make retirement contributions clear and transparent for your employees. Effortless, accurate, and small-business friendly.

Advantages vs. Disadvantages of a 401(k)

| Advantages | Disadvantages |

|---|---|

| Tax Advantages Traditional 401(k) offers immediate tax savings, while Roth 401(k) provides tax-free withdrawals in retirement. | Limited Investment Choices Employees can only invest in the options provided by the employer’s plan. |

| Employer Matching Many employers match contributions, increasing retirement savings at no extra cost. | Early Withdrawal Penalties Withdrawals before age 59½ usually incur a 10% penalty plus income taxes. |

| High Contribution Limits Allows employees to save significantly more each year compared to other retirement accounts. | Potential Fees Administrative and investment fees may reduce long-term returns. |

| Automatic Payroll Deductions Makes saving consistent and effortless through paycheck deductions. | Restricted Access Funds are intended for retirement and are not easily accessible without penalties. |

Conclusion

A 401(k) is a powerful tool for retirement savings due to its tax benefits and potential employer contributions. However, it's important to understand the rules, fees, and investment options associated with your specific plan With SecurePayStubs, you can automatically itemize employee 401(k) deferrals, employer contributions, and Roth vs. Traditional splits — giving employees a complete picture of their retirement savings.

Ensure your employees stay informed about their 401(k) contributions with SecurePayStubs Paystub Highlights!

Employers can now easily emphasize their employees' 401(k) contributions directly on their paystubs, ensuring clarity and transparency.

Here's how it benefits you:

Clear Emphasis : Highlight 401(k) contribution details prominently on employee paystubs, ensuring they're easily noticed and understood.

Enhanced Awareness : Empower employees to stay informed about their retirement savings by prominently displaying their 401(k) contributions on their paystub alongside regular earnings.

Compliance Assurance :Maintain regulatory compliance by clearly presenting 401(k) contribution information on paystubs, fostering trust and transparency.

Simplify the communication of 401(k) contributions with SecurePayStubs Paystub generator. Empower your employees with clear and accessible information about their retirement savings!